The Friday Alaska Landmine Chart: Giving up on the PFD is giving up on the Alaska economy and Alaska families

We explain why giving up on the PFD - as some appear to be doing - is also giving up on the Alaska economy and families

In the adjacent “Facebook chat room” during the taping Tuesday of a segment on Alaska revenue policy for this week’s “Weekly Top 3” podcast, Rep. Kevin McCabe (R-Big Lake) wrote the following:

People have totally given up on the PFD [Permanent Fund Dividend]. Very little pro PFD communication from constituents in the last 2 years.

We have heard some others say the same. That may be just their experience, or it may be broader. But it really doesn’t matter to us.

While others may view the PFD in terms of “rights” or “compensation for lost mineral rights” - and are growing weary in the battle for those - we view it almost entirely as a matter of ongoing economic policy.

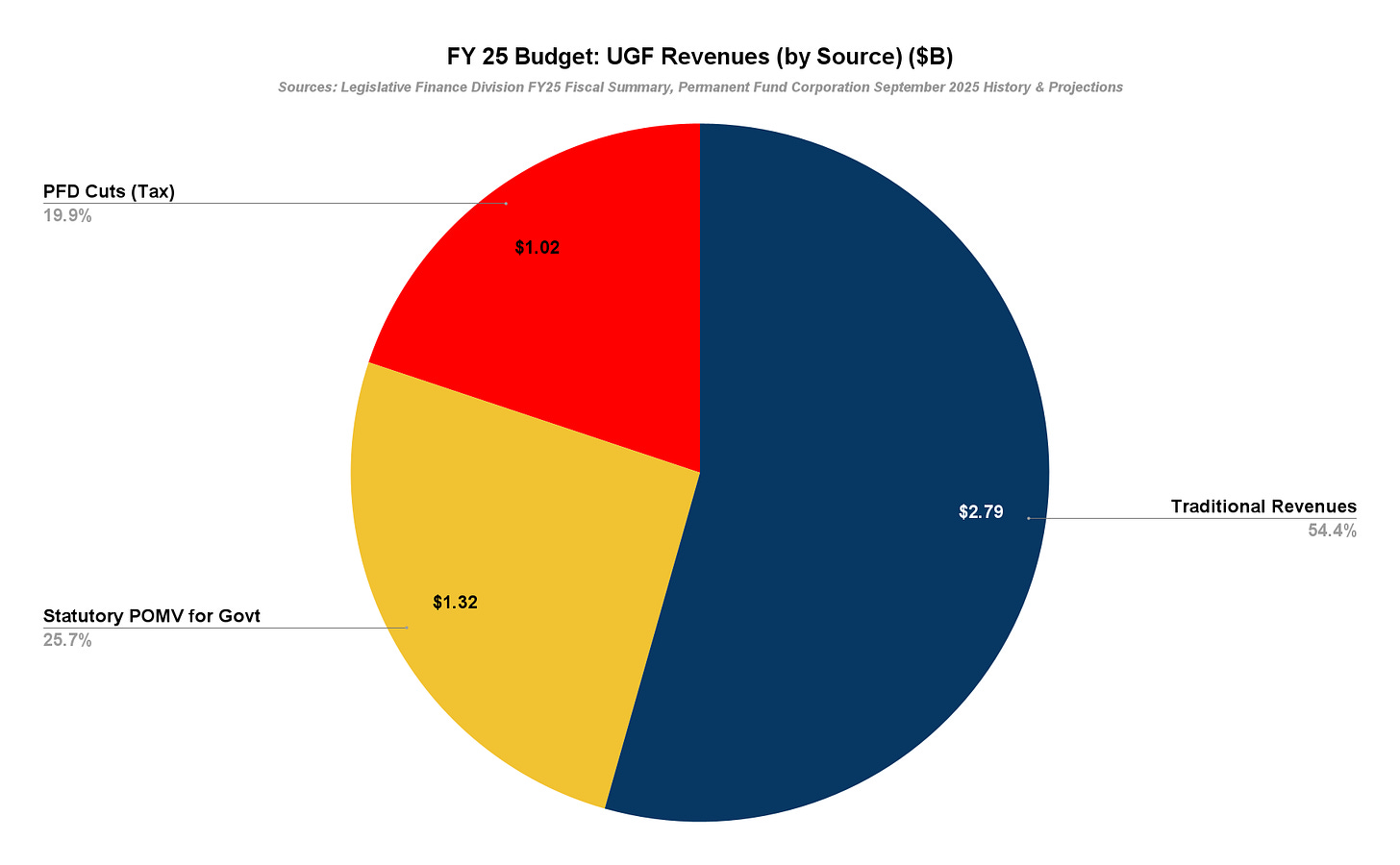

Here is how the state has financed Fiscal Year (FY) 2025 Unrestricted General Fund (UGF) spending.

In the FY25 budget, the state projects spending $5.13 billion in UGF, plus holding another $147 million in reserve (what some refer to as a “surplus”) for use in next session’s supplemental. On the other side of the ledger, it proposes to finance the total $5.28 billion with $2.79 billion in traditional revenues, $1.32 billion in the portion of the percent of market value (POMV) draw provided under current law to help pay for government spending, and $1.02 billion in PFD cuts.

The PFD cuts are about 44% of the current law PFD.

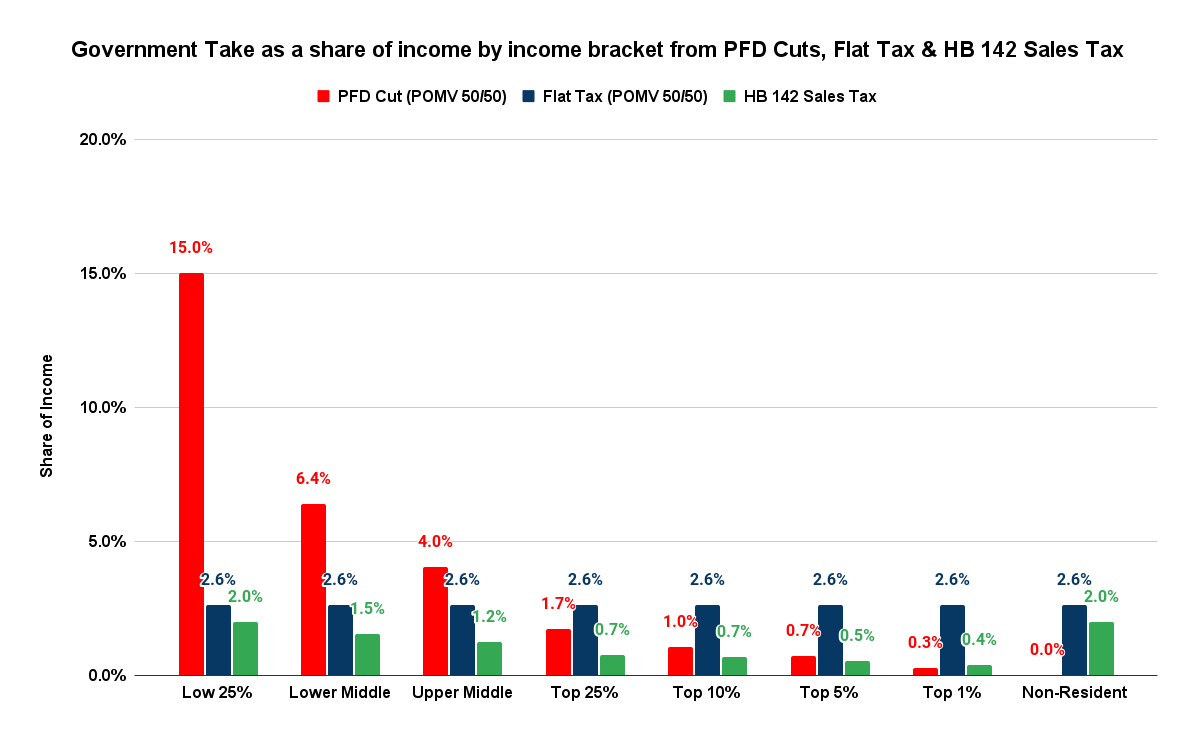

However, PFD cuts are not the only way to fill the budget hole. Using the rule of thumb included in the Legislative Finance Division’s (LFD) pre-session Overview of the Governor’s [FY25} Budget, the same amount could be raised through a roughly 3% flat tax. As we explained in a previous column, because of its broader base Representative Ben Carpenter’s proposed HB 142 two-percent sales tax also would raise about the same amount.

And, as we demonstrated in a chart in that column, because of the broader base, both would take less from middle and lower-income - 80% of Alaska families - than PFD cuts.

In that context, it is hard to dispute that restoring PFD cuts (by adopting lower-impact revenue substitutes) is the right thing to do. On its face, increasing the portion of household revenue retained by 80% of Alaska families by using a broader-based, low-impact revenue source is certainly the right thing to do. We honestly can’t imagine the justification for an argument that Alaska families - particularly middle and lower-income Alaska families - should experience deeper cuts in their income levels when realistic alternatives exist under which they would pay less.

But it's more than that. Restoring PFDs is both pro-Alaska economy and pro-Alaska family. Unless Rep. McCabe thinks those aren’t worthwhile objectives, he (and others) shouldn’t be among those “giving up” on the PFD.

As now, it seems occasionally necessary to remind those involved in Alaska fiscal policy of two fundamentals related to the PFD. First, as the 2016 study for the then-administration of former Governor Bill Walker by researchers at the University of Alaska-Anchorage Institute of Social and Economic Research (ISER) concluded, PFD cuts have “the largest adverse impact on the economy per dollar of revenues raised.”

Some occasionally seek to dismiss the finding as “outdated” or limited to just a “short-run impact.” But the two factors that made the 2016 statement accurate make it equally accurate today (and tomorrow).

Paying for “excess” government spending (over the level supported by traditional revenues plus the portion of the POMV draw provided under current law for government spending) entirely through PFD cuts means that only Alaskan families bear the burden. Unlike in every other state in the nation, as well as the District of Columbia, neither non-residents nor the oil companies contribute an additional dime. That means Alaskan families are paying money they otherwise could be putting back into the Alaska economy to cover a share of government spending that should be paid for instead through non-residents and the oil companies.

By relying solely on PFD cuts, Alaska is foregoing the boost to its internal economy that every other state receives from non-residents and their equivalent of the oil companies.

The second factor is, as the study said, that “lower [and we would add, middle]-income Alaskans typically spend a higher share of their income than higher-income Alaskans do, so more regressive measures will have a larger adverse effect on expenditures.”

As ISER Professor Matthew Berman, a co-author of the 2016 study, said just last year in an Anchorage Daily News op-ed, “A cut in the PFD is … the most regressive [revenue measure] ever proposed.” It is not an overstatement to say that easily makes it also the approach that has the “largest adverse impact” on the economy.

Both these factors are as true today as they were in 2016. Relying solely on PFD cuts means that non-residents and the oil companies are escaping, as former Governor Jay Hammond put it, “scot-free” from contributing to “excess” government costs. Using PFD cuts also means that those Alaskans that typically spend the largest share of their income boosting the economy are seeing a significant share of those dollars diverted instead to the government.

In short, the failure to develop a broad-based, balanced (non-regressive) substitute revenue source is hurting the Alaska economy.

Rectifying that by substituting for PFD cuts one or more broad-based, balanced revenue sources that reach non-residents and the oil companies is pro-Alaska economy.

Those two factors also contribute to the second fundamental issue that Alaska policymakers seem often to overlook. As ISER researchers, led by Professor Berman, said in a 2017 follow-up to the 2016 study, “a cut in PFDs would be by far the costliest measure for Alaska families.”

Think about that for a moment. The Legislature is intentionally using the revenue measure that takes the most from middle and lower-income families - which together constitute 80% of Alaskan families.

At a time when legislators profess to be concerned about outmigration, they are using the very revenue measure that hurts the category outmigrating the most. They are adding to the economic burdens contributing to outmigration, not improving them.

In short, failing to develop a broad-based, balanced (non-regressive) substitute revenue source is hurting Alaskan families, and they are showing that by voting with their feet.

We get that some who think about the battle for the PFD as being over rights or “compensation over lost mineral rights” may be giving up out of frustration over their failure to make headway.

But legislators who claim to be concerned about the Alaska economy and Alaska families should not. This isn’t really about the PFD. It’s about using the revenue source that has the lowest economic impact and is best for Alaska families.

If legislators are truly concerned about those issues - and all of them should be - they have the means and should feel an obligation to continue to push to make both better.