The Friday Alaska Landmine column: Where are we headed?

This session, the Legislature has ramped up spending to the point that it is likely shortly to blow through even POMV 25/75. That raises two significant issues for the coming election cycle.

As we approach the end of the Fiscal Year 2025 (FY25) budget cycle – and the start of the 2024 election cycle – we thought it would be useful to assess how the current Legislature is positioning Alaska’s fiscal situation for the road ahead.

Somewhat differently than we have in past assessments, we are doing this one using a more simplified, “cut to the chase” approach. We start by calculating the difference between projected spending and traditional revenues to determine what portion of the projected annual percent of market value (POMV) draw will be required to close the resulting deficit. Under the current Legislature’s effectively “leftover” approach for calculating the Permanent Fund Dividend (PFD), the remainder largely sets how much of the annual POMV draw is available for the PFD.

We then compare that to the projected current law (statutory) PFD for each year to determine how much of the current law PFD is being withheld and diverted to government – effectively taxed – under the current Legislature’s approach for covering the deficit. We express the result as a percent of projected Alaska Adjusted Gross Income (AGI), adjusted to include the full PFD.

We use the percent of projected Alaska AGI as a basis for evaluating the PFD cut because it is a useful way of capturing the impact of the cut on the overall Alaska economy. If distributed according to current law, the PFD would add to Alaska personal income – the total amount of money received by individuals or households in Alaska. By withholding a portion of the PFD and diverting it to government, PFD cuts act as a tax on that personal income, reducing the amount of income Alaskan individuals and households have available to spend, just like any other sort of personal income tax does. The percent represents the amount of the tax, comparable to the impact of average federal income tax rates.

Here’s the result over the current “10-year forecast” period:

On the track set by this Legislature, the deficit as a percent of the annual POMV draw is projected to grow from 69% for FY24 to 86% by FY30 before moderating slightly back to 82% by FY33. The average over the period is projected at 81%. As the chart shows (in red), on its current track, the deficit is projected to exceed the nominal POMV 25/75 approach adopted this Legislature by the Senate majority beginning next year, with the FY26 budget to be developed next session by those elected this coming fall – and to remain above that level every year after for the remainder of the period.

The level of the PFD cut (tax) as a percent of Alaska AGI is projected to grow from 3.6% for FY24 to 5.9% by FY31 before moderating slightly back to 5.4% by FY33. The average over the period is projected at 4.9%.

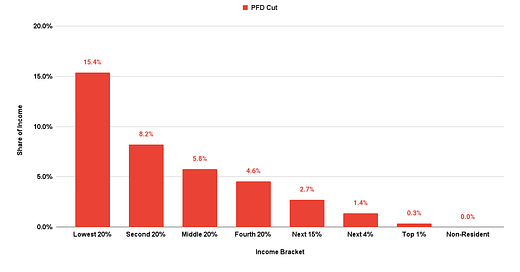

It is important to recall that the percent is the average tax on Alaska AGI over each period. As we have explained often on these pages, because PFD cuts are exceedingly regressive – take increasingly more from middle and lower-income Alaska families than those in the upper-income brackets – the level of take will be significantly higher than the average for 80% of Alaska families (those in the middle and lower-income brackets) and significantly lower than the average for those in the top 20%.

Based on the data included in a recent analysis of Alaska income by income bracket by the Institute on Taxation and Economic Policy (ITEP), this is the estimated impact of the projected cuts (tax) by income bracket. This estimate is based on the analysis we did in connection with our January 19, 2024, column on these pages, in which the level of the overall PFD cut is roughly the same as projected for FY25:

While the percentage impact on each bracket will continue to rise over the period, together with the level of PFD cuts, the relationship between the brackets—in other words, the level of regressivity—will likely stay roughly the same. Middle and lower-income Alaska families will be adversely impacted, those in the upper-income bracket will contribute an increasingly trivial share, and non-residents will contribute nothing.

The projections in our model about the levels of deficit spending and PFD cuts vary some from those made using the “4-26-24 Update” to the Legislative Finance Division (LegFin)’’s “Fiscal Plan Working Group Model,” as presented at the House Ways & Means Committee May 1, 2024, meeting and adjusted for updates to the operating and capital budgets since that time, plus the “Outstanding Items” related to FY25 spending identified in LegFin’s April 25, 2024 “Fiscal Update” presented to the Senate Finance Committee.

Through FY30, the differences between our and the LegFin models are relatively small – the deficits as a percent of POMV are within 1% of each other – and relate largely to differences in the way in which projected supplementals for each year are handled. The differences grow somewhat larger from that point forward, however, as the amounts included for the annual POMV draw in LegFin’s projections grow smaller than those included in the Department of Revenue’s Spring 2024 Revenue Forecast, which were based on the then most recent projections made by the Permanent Fund Corporation and which are the numbers we use in our model.

The net effect of that difference is that the size of the PFD cut and the resulting projected tax rate calculated using LegFin’s numbers grow higher than in ours. The average tax rate over the period using LegFin’s numbers averages 5.2%, while that from our model averages 4.9%.

To us, these trends have significant implications for the 2024 election cycle. The Legislature’s actions this session regarding the FY24 and FY25 budgets have grown spending for those years and, by resetting the base, over the course of the remaining ten years significantly, to the point that, from the start, the projected deficits facing the incoming Legislature will outstrip the POMV 25/75 approach and equally as quickly push the projected average tax rate significantly above 4%.

It is hard to overestimate how much the actions of the Legislature in this session are contributing to those results. In its “Overview of the Governor’s [FY25] Request” (Overview) published at the start of this session, LegFin estimated the FY25 spending baseline, before the PFD, at $5.11 billion. Nearing the end, the amount LegFin now anticipates to be appropriated by the current Legislature, including an anticipated $50 million supplemental next year, at $5.59 billion, fully 9.5% higher. Here’s the impact extrapolated over the remainder of the period using the reset FY25 base, compared to the baseline amounts included in LegFin’s earlier Overview.

From the actions of the Legislature this session alone, unrestricted general fund (UGF) spending levels over the period are projected to grow on average by over 8% per year beyond the previous baseline. What were already significant deficits in terms of their impact on Alaska adjusted gross income have become staggering.

It is not inaccurate to say the current Legislature has used up all the slack that remained in the system. The next and future Legislatures will be faced with increasingly difficult choices.

To us, this sets up two important and separate questions for this year’s election cycle: Should future Legislatures allow spending to continue on the path this Legislature has set, and should future Legislatures continue to fund deficits through PFD cuts?

The second question exists independent of the first. Alaska has long since passed the point of no return in restraining spending to the level capable of being funded by a combination of traditional revenues plus the portion of the annual POMV draw remaining after the current law PFD. That is the point at which former Governor Jay Hammond argued in his seminal book on Alaska fiscal policy, Diapering the Devil, that additional revenues should be raised through “a combination of user fees and taxes,” in short, through broad-based mechanisms.

Instead, upon reaching that point in the mid-2010s, past Legislatures plowed ahead and raised the additional revenues required to balance the budgets through PFD cuts – the option which long-time Harvard and Yale-trained Professor Matthew Berman of the University of Alaska-Anchorage’s Institute of Social and Economic Research (ISER) recently concluded is “the most regressive tax ever proposed,” and which Berman and other ISER researchers said in 2016 and 2017 studies of the situation has the “largest adverse impact on the Alaska economy” and is “by far the costliest option for Alaska families.”

In this session, the current Legislature demonstrated the logical consequence of the decision to plow ahead using PFD cuts. As spending continues to grow to increasingly high levels, using PFD cuts to fund the current law deficits is resulting in larger and harsher regressive tax rates. Even as legislators claim they are setting a limit, such as the Senate’s proposed POMV 25/75 approach, they nevertheless are adopting spending levels that, if continued, will plow through that as well.

We anticipate some – particularly some self-styled “fiscally conservative” Republicans – will attempt to dodge the second question this coming election cycle by claiming that the state’s fiscal problems can be solved through spending restraint alone.

But that’s a hugely unconvincing argument. Republicans – even some of those that style themselves as “fiscally conservative” – have been prominent in the majorities establishing the FY25 spending levels. Vows to bring restraint have become similar to claims that “I promise not to kill again … next time.” And that argument flies in the face of experience in any event. Solid majorities have continued to spend, regardless of the pledge by some to implement restraints.

Moreover, even if a majority were able to implement some spending restraints, it would not solve the second issue. Even with spending restraints, deficit spending would continue; it would just continue at lower levels. As a result, the second question remains: how do candidates propose to pay for the deficits? Through continued regressive PFD cuts (taxes) or, as former Governor Hammond proposed, through less regressive, lower-impact, broad-based alternatives.

This session’s results show that, as a body, this Legislature really has no interest in exercising spending restraint and is perfectly comfortable continuing to use PFD cuts (taxes) to fund the resulting deficits, regardless of their adverse impact on the state’s economy and Alaska families.

We look forward to learning whether their opponents will offer different answers in the coming campaign.