The Friday Alaska Landmine column: “Opportunity Cost” and Alaska fiscal policy

Some attempt to apply the concept of "opportunity costs" when analyzing the PFD, but they stop halfway through. We finish the work.

Opportunity cost is the value of the next-best alternative when a decision is made; it’s what is given up.” – Andrea J. Caceres-Santamaria, Senior Economic Education Specialist, Federal Reserve Bank of St. Louis, “Money and Missed Opportunities” in Page One Economics, Federal Reserve Bank of St. Louis

In various legislative and other debates about the Permanent Fund Dividend (PFD), we regularly see references, either explicitly or implicitly, to “opportunity costs.” Often, those seeking to denigrate and push for cuts in the PFD use the concept to rationalize their actions.

They claim that spending the money designated by statute for PFDs instead on K-12 education, the University, through the capital budget on “infrastructure,” or on a host of other programs produces better “returns” for Alaskans than distributing the money through PFDs. A recent, explicit example of such an argument is here.

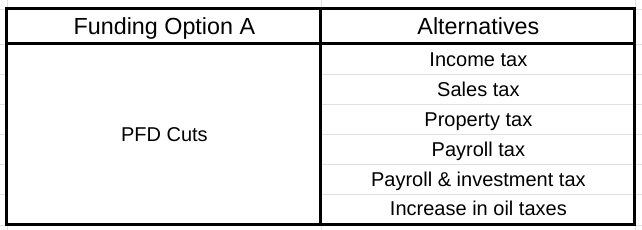

But that is only half the analysis. The other, equally important question is, if it is important to spend money on those things, what is the best way to pay for the spending? Cuts in the PFD – or what one long-time Alaska economist calls a “tax” on the PFD – are only one way. There are numerous others: changes in oil taxes, income taxes of various types, sales taxes, investment taxes, payroll taxes, and even a statewide property tax. For those interested, we compiled the approaches suggested in various studies over the past few years in a previous column.

Put in the same terms, the second question is, what are the opportunity costs of funding the spending through PFD cuts compared to the other ways?

Despite the detailed attention those studies have given to the issue, we very seldom see those claiming that distributing PFDs is less important than other uses of the funds complete the analysis by addressing the best way of funding those uses.

Why is that? In our experience, there are two reasons.

The first reason is simple greed. As we explained in a previous column, they realize that most, if not all, of the funding alternatives have a far lower impact on Alaska families and the overall Alaska economy than PFD cuts but would take more from them, their corporations, or their members (if a trade association or union). To avoid confronting that outcome, they simply ignore the second half of the analysis, ending their reference to “opportunity costs” halfway through and claiming the first issue is the only one that matters.

The second reason is fear. As we also explained in a previous column, well-known politico Scott Kendall let the cat out of the bag on this motivation in a tweet a few months ago by effectively admitting that the same amount of funding likely would not occur if it had to be raised in a way that impacted the top 20%, non-residents or the oil companies. Put another way, those groups wouldn’t consider the spending anywhere near as “essential” if the opportunity cost involved their money. They only consider the spending “essential” if the money to pay for it is diverted from someone else, such as, in the case of PFD cuts, mainly from middle- and lower-income Alaskan families.

But it’s the height of hypocrisy for legislators (all of whom are in the top 20% due to the recent legislative pay raise) and others to stop the analysis halfway through. To adopt an old truism, “what’s good for the goose is good for the gander.” If an opportunity cost analysis is an appropriate basis on which to evaluate and decide on distributing PFDs compared to various spending categories, then it should be an equally appropriate basis on which to evaluate and decide on funding mechanisms.

The truth is that referring to “opportunity costs” is a cover for attempts to dodge the funding issue. It’s not an honest effort to chart the best course for Alaska’s fiscal policy.

Those seeking to avoid the second half of the issue can’t even claim that the outcome is uncertain. That second half of the analysis has largely already been done.

Here are the alternatives. Exactly like PFD cuts, four of the first five alternatives are reductions – taxes – on personal income. The sixth is a reduction in corporate income. The third, a property tax, essentially is a targeted wealth tax.

The impact of PFD cuts compared to the first three alternatives – income, sales, and property taxes – was extensively analyzed in a 2016 report for the then-Walker administration by researchers at the University of Alaska-Anchorage’s Institute of Social and Economic Research (ISER). The first, second, fourth, and fifth were also analyzed in a 2017 report for the Legislature prepared by the Institute on Taxation and Economic Policy (ITEP). The sixth – an increase in oil taxes – was analyzed on a stand-alone basis in a 2021 fiscal model by the Department of Revenue (DOR).

The 2016 ISER report found that, on a dollar-for-dollar basis, PFD cuts both took more as a share of income from middle and lower-income (which, combined, constitute 80% of) Alaska families and had a “larger adverse impact” on the overall Alaska economy – in short, had a higher opportunity cost – than the first three alternatives. Looking at the same results in different ways, follow-up reports by ISER researchers in 2016 and 2017 also concluded that, of the alternatives, PFD cuts were “by far the costliest measure for Alaska families” and also that, more than the others, resulted in increased poverty levels in the state (which, in turn, leads to even higher state spending).

Following that, the 2017 ITEP study confirmed that, again on a dollar-for-dollar basis, PFD cuts took more as a share of income from middle and lower-income (again, combined, 80% of) Alaska families – had higher opportunity costs – not only than income and sales taxes but also a payroll tax and a combined payroll and investment tax. A follow-up 2021 ITEP report enables the same finding comparing PFD cuts to various flat tax approaches.

While DOR’s 2021 fiscal model does not directly compare the impact of an oil tax increase to that of PFD cuts, as we explained in a previous column, it does imply that, at least up to a certain level, increased oil taxes have little to no impact on production levels (and thus, investment levels), suggesting that, at least up to those levels, the opportunity cost to Alaska families and the overall Alaska economy of that option likely is close if not equal to zero, but in any event is much less than PFD cuts.

The point here is simple. If some believe that the “opportunity cost” to Alaska families and the overall Alaska economy is the appropriate way to analyze the best way forward on fiscal issues, then it should be applied consistently both to evaluating the amounts to be spent in various areas and to the manner in which those amounts are funded.

Applying the approach consistently across both makes crystal clear that if additional spending above the base level covered by traditional revenues, plus the “other half” of Permanent Fund earnings, is needed on K-12, the University, capital budgets, or other programs, the funding should be raised other than through PFD cuts, as that approach has the highest “opportunity cost” – in terms of adverse impact on Alaska families and the overall economy – of any of those studied.

In short, the next time someone says in a discussion about PFDs, “But oh, the opportunity costs,” help them complete the analysis by saying, “Yes, exactly. The opportunity costs of paying for the added spending through PFD cuts instead of any of a number of other revenue alternatives are huge. Since that is your concern, help us push for using one or more of the alternatives instead.”