The Friday Alaska Landmine column: The Orwellian approach to Alaska fiscal policy

The terminology used by some to discuss Alaska's fiscal policy has become like the Newspeak of George Orwell's book, 1984; we explain how

A few months ago, Representative Alyse Galvin (I – Anchorage) authored an op-ed in the Anchorage Daily News in which all of her colleagues in the minority Alaska House Coalition joined. The op-ed, titled “By neglecting education, Alaska is failing its children,” was a fairly typical pitch for increasing the level of state funding for education, both in the near term through a reversal of Governor Mike Dunleavy’s (R – Alaska) partial veto of the one-time increase of the base student allowance (BSA) included in the FY24 budget, as well as the longer term.

But it contained one line that immediately caught our attention. Addressing the issue of funding for the proposed increases, the op-ed argued, “And there is a budget surplus. So, what’s the hang-up?”

We strongly took issue with that in a subsequent column on these pages (“The Alaska House Coalition is lying”), explaining that there was no “budget surplus” but only a fiscal sleight of hand that had transferred the burden of a substantial FY24 budget deficit from the unrestricted general fund budget to the Permanent Fund Dividend (PFD) and through that, onto the backs of middle and lower-income Alaska families.

We didn’t think much about it further, however, until last week when we saw another reference to the so-called FY24 budget “surplus.” In reflecting on that, we realized that it’s just the latest step in an ongoing effort to create a terminology related to Alaska fiscal matters that attempts to normalize some actions and trivialize others that otherwise should stand out.

As we have continued to think about it, the effort reminds us in many respects of the similar effort described in George Orwell’s dystopian novel, 1984, to change the narrative about political matters in the fictional nation of Oceana through the use of “Newspeak,” the process of creating new words and eliminating or changing the meaning of existing words in a way that conveys the reverse meaning.

As Orwell described in an appendix to 1984 titled “The Principles of Newspeak,”

The purpose of Newspeak was not only to provide a medium of expression for the world-view and mental habits proper to the devotees of Ingsoc [the ruling political party], but to make all other modes of thought impossible. … This was done partly by the invention of new words, but chiefly by eliminating undesirable words and by stripping such words as remained of unorthodox meanings, and so far as possible of all secondary meanings whatever.

In Newspeak, “war” becomes “peace,” a forced labor camp becomes “joycamp,” past facts appearing in the press that are no longer consistent with current political views become “malquoted,” lies, propaganda, and distorted historical records become “truth,” distorting a historical record becomes “rectify,” starvation and rationing become “plenty,” and torture and brainwashing become “love.” “Free” and “equal” are stripped of the political meaning we give them today, becoming largely empty shells, and, as Orwell had his main protagonist say, “in the end, the Party would announce that two and two made five, and you would have to believe it.”

The terminology some are using for Alaska fiscal policy does not go as far as that, but within the confines of fiscal matters, there are strong similarities.

In our experience, the effort goes back to 2017 when, at the direction in part of then-Senator (and Senate Finance Committee member) Natasha von Imhof, the Legislative Finance Division (LegFin) started referring to Permanent Fund Dividends (PFD) as “unrestricted general funds.” As we explained in a previous column,

… by far the biggest budget gimmick in terms of dollars is LegFin’s unilateral reclassification of the Permanent Fund Dividend (PFD) from Designated General Funds (DGF), where it belongs under LegFin’s own rules, to Unrestricted General Funds (UGF).

LegFin defines what qualifies as DGF in footnote 3 of its Fiscal Summary as follows:

Designated general funds include 1) program receipts that are restricted to the program that generates the receipts and 2) revenue that is statutorily designated for a specific purpose.

The PFD clearly falls into the second category. AS 37.13.145(b) provides as follows: “At the end of each fiscal year, the corporation shall transfer from the earnings reserve account to the dividend fund established under AS 43.23.045, 50 percent of the income available for distribution under AS 37.13.140.”

There is no clearer statutory designation of revenue “for a specific purpose” on the books.

But that recharacterization in violation of LegFin’s own budgetary rules, even as it continues today, turned out to be only the opening shot in the effort.

Subsequently, during the Senate floor debate on the FY22 budget during the 2021 legislative session, for example, then-Senator von Imhof accused those pushing for the distribution of a full Permanent Fund Dividend (PFD) of “greed and entitlement.” Similarly, just last session, Representative Sara Hannan (D – Juneau) accused those pushing for a higher PFD level than her of seeking a “free ride.”

As we explained most recently in last week’s column, however, if there is “greed and entitlement” in Alaska fiscal policy, it lies with those in the top 20% income bracket who seek to use PFD cuts as a means of pushing the burden of paying for the state’s deficits down to middle- and lower-income Alaska families so that those in the top 20% can continue to enjoy tax-free government services themselves.

And as we also explained there, if there is a “free ride,” it is being received by those on the House Finance Committee, including Rep. Hannan, and others in the top 20% who, by using PFD cuts to push a disproportionate share of the state’s fiscal burden onto the backs of the remaining 80% of Alaska families living in the middle- and lower-income brackets, can dodge bearing a proportionate share of government costs – in other words, benefit from a free ride for the difference – themselves.

Consistent with the principles of Newspeak, as part of an ongoing perversion of the terminology, they are using the terms to mean the exact opposite of the consequences their actions create.

There are other examples.

As we’ve explained in a previous column, AS 37.13.145(b), the PFD statute, is the same in terms of the law as AS 37.13.144(b) and AS 37.13.145(e), the percent of market value (POMV) statutes. Neither has been amended or repealed; both are as vibrant as any other statute. Yet, some legislators, and even some in the media, sometimes refer to the second as “the law” and either ignore the first entirely or, when they do, refer to it as “obsolete,” notwithstanding that despite repeated efforts in successive legislatures, the statute remains unchanged.

Others refer to a statutory PFD as a “mega” PFD, the PFD resulting from the POMV 50/50 approach as a “big” PFD, and the PFD resulting from the POMV 25/75 approach as “reasonable” (for now).

Yet, they ignore the flip side of those approaches, where, as former Senate President Rick Halford once explained, PFD cuts to middle- and lower-income (80% of) Alaska families turn into $100,000 dividends to those in the top 1%. Calling a $3,000 statutory dividend “mega,” while at the same time completely ignoring a $100,000 dividend (30+ times greater) to those in the top 1%, is a classic Owelian move.

Still, others claim that Alaska has “no taxes,” even when long-time Harvard and Yale-trained University of Alaska-Anchorage’s Institute of Social and Economic Research (ISER) economics professor Matthew Berman has made clear that “a cut in the PFD is a tax — the most regressive tax ever proposed.”

The goal of these latest Newspeak efforts is the same as when former Senator von Imhof helped start the ball rolling: emphasize the need to use PFD cuts as the preferred form of fiscal balancing while, at all costs, hiding from sight the hugely beneficial impact of doing so on the top 20%. Given that, with the recent pay increase, all of the members of the Legislature are now in the top 20%, it should come as no surprise that the efforts to push the use of Alaska’s fiscal Newspeak terminology are not only continuing but growing.

But it continually surprises us when those in the media go along, not even attempting to explain the flip side effect, and indeed, sometimes being at the forefront of the effort to adopt the Newspeak terminology. Like the writers for 1984 Oceania’s The Times, sometimes it seems Alaska’s media is more concerned about parroting Alaska’s top 20% than actually digging into the facts.

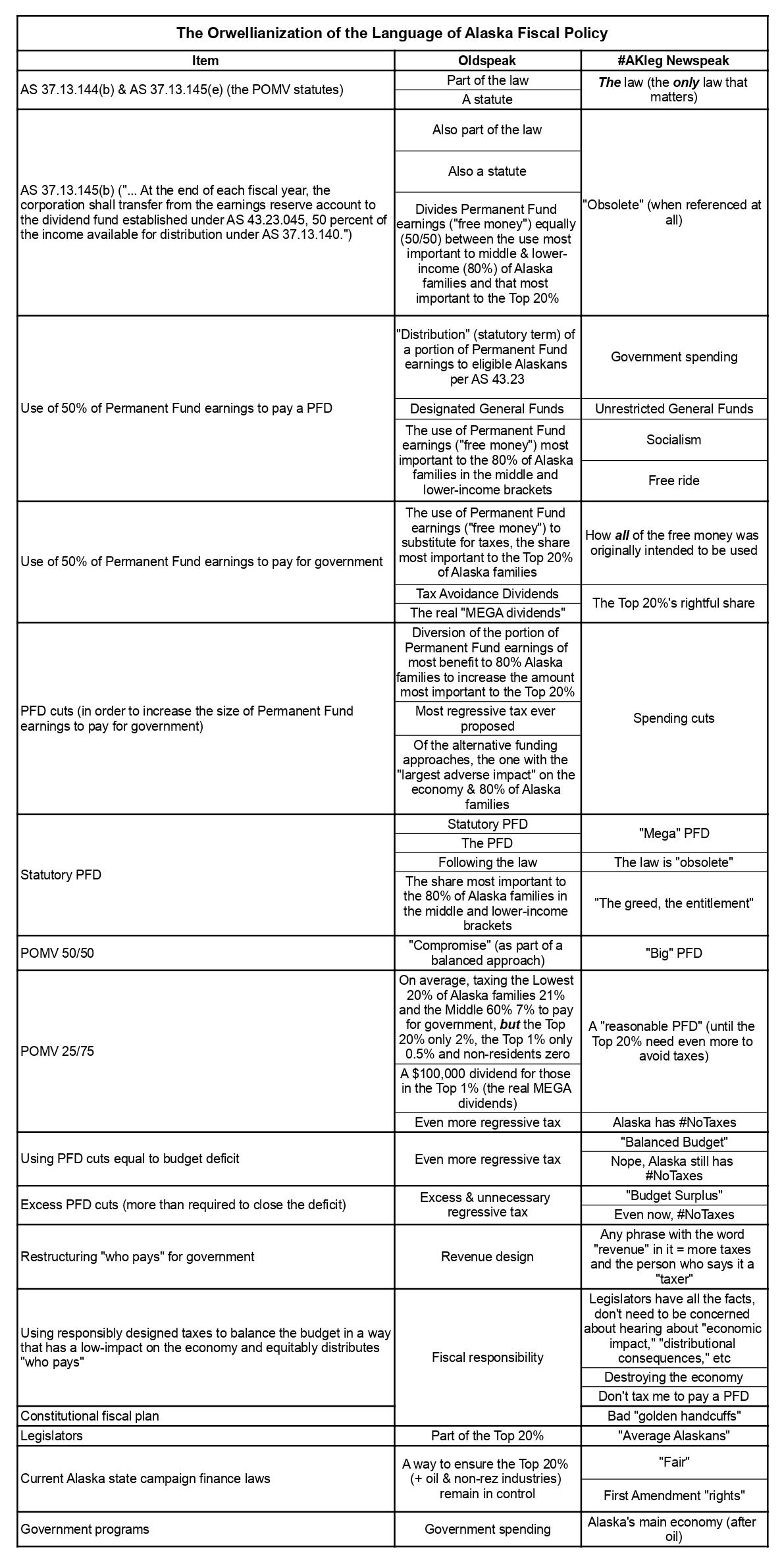

To help explain our point, we have developed the following partial dictionary of the various forms of fiscal Newspeak currently used on Alaska fiscal issues. Some may find it useful in understanding how much Alaska’s fiscal Newspeak has permeated – and through that, is helping to control – the discussion.