The Friday Alaska Landmine column: Alaska's Super Socialists

Some who call the PFD "socialist" are, in fact, closet "super socialists" attempting to divert attention from their own, even larger "free money" benefits

Some often refer to Permanent Fund Dividends (PFD) as “socialist” and those who advocate for them as “socialists.” The basis for the claim is that PFDs come from “unearned” Permanent Fund earnings, and thus, those who receive them benefit from “free money.”

But if benefitting from “free money” is the standard by which we are judging things, then Alaska has a class of “super socialists” that make those who advocate for PFDs seem like “pikers” (definition: “one who does things in a small way”). As we have explained in previous columns, while PFDs are measured on an individual basis in terms of hundreds or, at most, low single-digit thousands of dollars, the benefits received by the “super socialists” are measured in the tens and hundreds of thousands and, indeed, in some cases, in the tens and hundreds of millions of dollars.

Given the size of its state government, absent Permanent Fund earnings, Alaskans and those doing business in Alaska would be paying significant taxes to cover its costs. The “free money” from Permanent Fund earnings covers that, enabling some Alaskans to avoid paying what otherwise would be significant tax bills.

Non-residents engaged in commercial activity in Alaska also benefit. Unlike in every one of the other 49 states and the District of Columbia, in Alaska, non-residents escape being taxed in any significant way at the state level due to the use of the “free money” from Permanent Fund earnings to cover their share. As former Governor Jay Hammond put it in his seminal book on Alaska fiscal policy, Diapering the Devil, non-residents largely get off “scot-free” as a result.

Some businesses operating in Alaska also benefit substantially. For example, as we’ve explained in previous columns, the oil industry benefits from the use of the “free money” from Permanent Fund earnings to help preserve the artificially low oil tax rates it pays, which are set below the “revenue-maximizing” level envisioned by the Alaska Constitution.

In short, by shielding them from taxes, some Alaskans, non-residents, and the oil industry benefit just as much from the “free money” derived from Permanent Fund earnings as do those receiving a PFD.

Structurally, there is a difference in the way in which the benefits are received. Through PFDs, the benefit is received in the form of cash deposited into the recipient’s bank accounts. On the other hand, by avoiding taxes, those benefitting through tax avoidance are able to keep an equivalent amount to the taxes they would otherwise pay in their bank accounts. They benefit from what we have termed in previous columns a “Tax Avoidance Dividend” (TAD).

From an economic perspective, however, the benefit to those who receive their “free money” through a TAD is every bit as real to them as those who receive it in the form of a PFD. Keeping money in your account because “free money” from another source is being used to cover your share of government costs is every bit as beneficial as having money deposited into your account. Both ways, the benefit from the “free money” ends up in your account.

But while the benefits from both the PFD and the TAD are structurally equivalent, as we’ve explained in previous columns, the size of the benefits are significantly different. And the recent use of PFD cuts to fund government – in effect, reducing the PFD to increase the TAD even further – is making the “free money” benefits to those who benefit most from the TAD even larger.

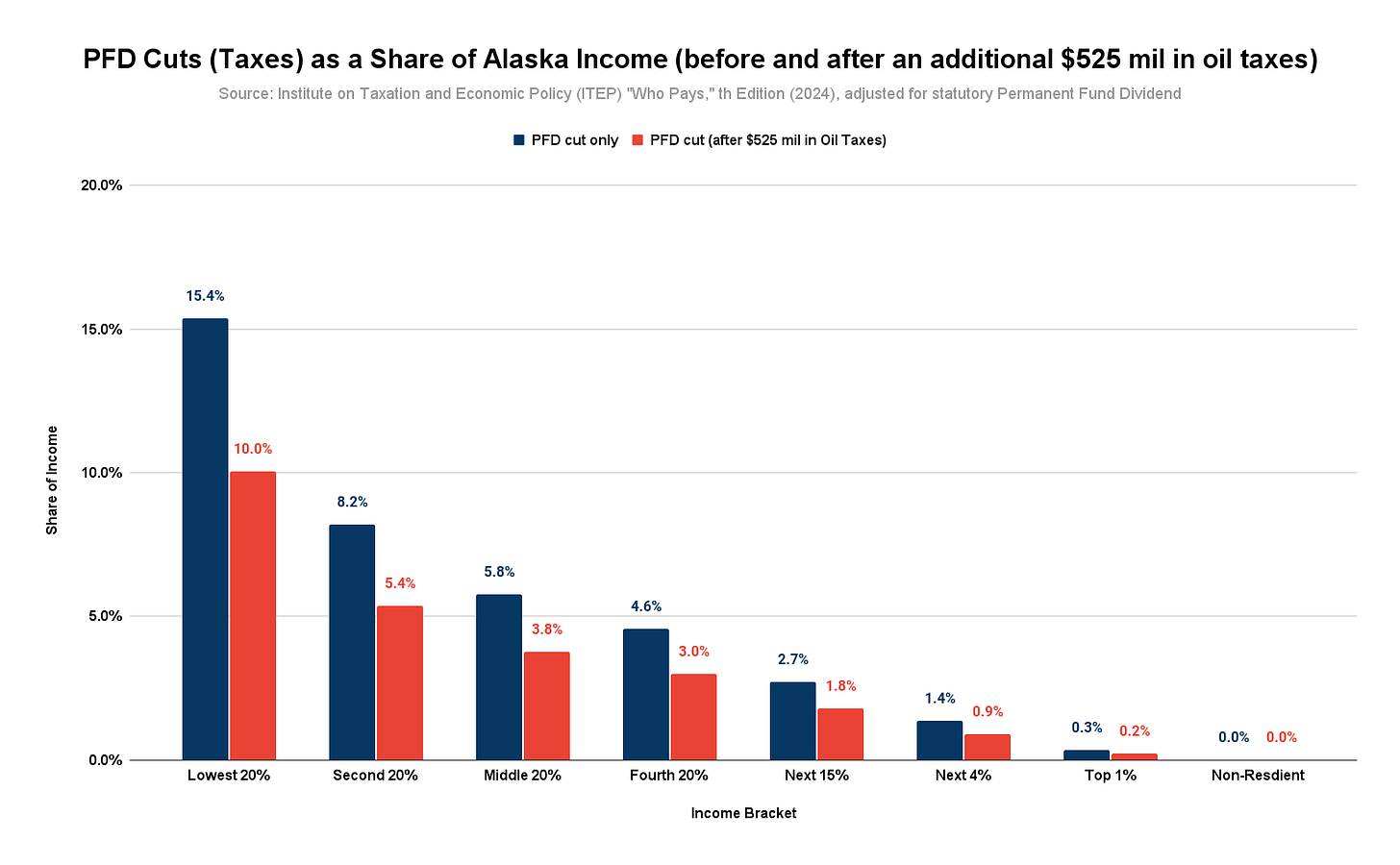

Even occasional readers of this column will be familiar with the charts we use that analyze the distributional impact of using PFD cuts to fund government. Here is the one we developed in our January 19, 2024, column based on the most recent distributional data developed by the Institute on Taxation and Economic Policy (ITEP). It shows the impact of the FY24 PFD cuts as a share of income by income bracket.

By using PFD cuts to close the current law deficit, those in the lowest 20% income bracket are seeing their income cut by 15.4%. Similarly, lower middle (“Second 20%), middle (“Middle 20%), and upper middle (“Fourth 20%”) are seeing their incomes cut by 8.2%, 5.8%, and 4.6%, respectively.

These compare to much smaller income losses if Alaska used a neutral (neither regressive nor progressive) flat tax instead of highly regressive PFD cuts to close the deficits.

A flat tax of approximately 4.2% of Alaska adjusted gross income (red line) would recover the same total amount from both Alaskans and non-residents as is being recovered through PFD cuts, but the distribution would be much different. Eighty percent of Alaska families – those in the middle and low-income brackets – would pay less. Those in the top 20% would pay more than they do using PFD cuts, but no more than any other household and still less than those in the other 80% pay using PFD cuts.

And instead of paying zero, non-residents would contribute the same amount of their Alaska-sourced income toward government costs as residents.

By applying them in reverse, these numbers allow us to estimate the additional benefits in terms of “free money” from Permanent Fund earnings some are realizing from using PFD cuts. Here’s the impact using the same adjusted average income per income bracket as we used in our earlier January 19th column:

As the distributional charts show, by using PFD cuts to fund government, middle and lower-income Alaska families are losing money as a share of income.

But those in the top 20% are making money. By using the additional “free money” from the Permanent Fund earnings diverted from PFD cuts to cover the deficits, on average, those in the 80 – 95% income bracket (the “Next 15%)” save an additional $3,035 in income per household, those in the 95% – 99% income bracket (the “Next 4%) save an additional $12,078 in income per household, and those in the 99% – 100% income bracket (the “Top 1%”) save an additional $65,208 in income per household over what their income otherwise would be after taxes. Using PFD cuts, their TADs – the benefit they derive from the “free money” from Permanent Fund earnings – go up significantly as the PFDs important to the other 80% of Alaska families plunge.

And, by escaping taxes entirely, non-residents are saving roughly $140 million in the aggregate from using PFD cuts. Put another way, their “free money” benefit from using PFD cuts to fund government instead of broad-based taxes is measured in the $100+ million range.

But it isn’t only the top 20% and non-residents that benefit from the increased use of “free money” for tax avoidance; the oil companies also do.

As we discussed in a previous column, we have estimated that, in the aggregate, oil companies pay $525 million annually less in state taxes than they would if their taxes were set at the “revenue-maximizing” level envisioned by the Alaska Constitution. Put another way, they are benefitting to the tune of hundreds of millions of dollars from the additional “free money” being used to shield them from taxes as a result of using PFD cuts instead.

If the oil companies instead were required to pay at the revenue-maximizing level to help cover government costs, here would be the impact on Alaska families by income bracket.

Even if the Legislature still used PFD cuts to recover the remainder, the level of PFD cuts would drop: from 15.4% before oil taxes to 10.0% for the lowest 20% of Alaska families; from 8.2% to 5.4% for those in the low middle-income bracket; from 5.8% to 3.8% for those in the middle-income bracket; and from 4.6% to 3.0% for those in the upper middle-income bracket.

And if Alaska required both the oil companies and non-residents to contribute to state government costs – in other words, if the additional benefits they currently receive from the “free money” used to cover their share of government costs were reversed – the burden on Alaska families would drop from a flat tax rate of 4.2% to a rate of 2.7%. Oil companies and non-residents would pay more as a result of stripping away their additional “free money” benefits derived from PFD cuts, but 95% of Alaska families would pay less than they currently are using PFD cuts.

Here’s the result:

In short, the “free money” benefit of Permanent Fund earnings doesn’t disappear as a result of PFD cuts. Instead, it simply is diverted to increasing the tax avoidance benefits realized by those in the top 20%, non-residents and oil companies. Looking at the relative amounts, if the PFD program is “socialist,” those benefitting from the use of the “free money” to shield them from taxes are super socialists.

As demonstrated above, households in the top 20% are realizing thousands to tens of thousands of dollars in additional “free money” benefits as a result of PFD cuts. In the aggregate, non-residents are receiving over $100 million in “free money” benefits. And the oil industry is the most super socialist of all, receiving in excess of $500 million in additional annual “free money” benefits courtesy of PFD cuts.

But the greatest irony isn’t that, once the covers are pulled back, many so-called “free market” advocates, in fact, turn out to be “super socialists.” Instead, it’s that some of the “super socialists” – especially some well implanted in the top 1% who want to keep the “free money,” “no taxes” scam running as long as they can – usually are among the most vocal in calling those who advocate for the PFD “socialists.”

It’s the epitome of the old Karl Rove political strategy, as a way of distracting attention, of calling your opponents something you know you are even more of first. It’s the ultimate hypocrisy.