The Friday Alaska Landmine column: The Legislature's FY25 "fiscal plan": The Top 20%, non-residents & oil contribute virtually nothing

How the Legislature's "workaround" fiscal solution this session pushes most of the burden to middle & lower-income families while others escape largely "scot-free"

A passage in a recent story in the Mat-Su Frontiersman by Tim Bradner wrapping up the events of this past legislative session caught our attention this past week. Here is the passage:

There was no progress on a long-term fiscal plan for the state but what has emerged is an informal understanding that the finance committees will budget according to funds available and not draw on reserves. That is a “workaround” solution that works for now and that avoids the political problems of adopting a formal plan.

The passage caught our attention for two reasons.

First, it grossly mischaracterizes the Legislature’s approach to this session. The “finance committees” did not “budget according to funds available.” Instead, they budgeted to a deficit and then filled that deficit by withholding and diverting a significant amount of funds away from their designated statutory purpose.

Second, it ignores the diversion’s impact on the vast majority of Alaskan families. That “solution” may “work for now” for those in the upper-income brackets (which includes all of the legislators), non-residents, and oil companies. Under the “workaround,” they essentially contribute nothing toward the additional costs of government over the “funds available.”

But it’s a poor plan for the remaining 80% of Alaskan families and the overall Alaska economy. As various studies by researchers at the University of Alaska—Anchorage’s Institute of Social and Economic Studies (ISER) have repeatedly advised, that approach is both “by far the costliest measure for Alaska families” and “has the largest adverse impact on the [Alaska] economy” of all the various revenue options.

The Legislature is failing Alaskan families and the overall Alaskan economy by continuing to rely on it.

Here is how that approach played out in this year’s Legislature.

In its Spring 2024 Revenue Forecast, the Department of Revenue projected $2.8 billion in traditional revenues for FY25. According to the latest estimates by the Permanent Fund Corporation, under current law (after accounting for the statutory PFD), an additional $1.3 billion is available for government from the annual percent of market value (POMV) draw from Permanent Fund earnings.

Together those total $4.1 billion in revenues. To borrow Bradner’s phrase, those are the actual “funds available” under current law.

The Legislature’s FY25 budget spends far beyond that, however, with the operating and capital budgets adding up to approximately $5.5 billion in unrestricted general fund (UGF) spending. Rather than “budget according to funds available,” as Bradner’s article claims, the result actually creates a deficit of $1.4 billion, or 25% of projected spending.

Using the rule of thumb provided by the Legislative Finance Division (LFD) in its “Overview of the Governor’s FY2025 [Budget] Request,” that deficit equals roughly 4.1% of Alaska adjusted gross income (AGI).

Rather than use an approach that requires all Alaska families to contribute equally at or near that level toward closing the deficit, however, the Legislature’s FY25 budget instead closes the deficit by reducing personal income distributed through the Permanent Fund Dividend (PFD) from $2.32 billion, the amount provided by current law as projected by the Permanent Fund Corporation in its most recent “History and Projections” report, to $914 million, a reduction (what long-time ISER Professor Matthew Berman, one of the authors of both the 2016 and 2017 ISER studies of the issue, astutely has called a “tax”) of over 60%.

By using PFD cuts to close it, the budget tilts the distribution of the impact significantly. Here is the result:

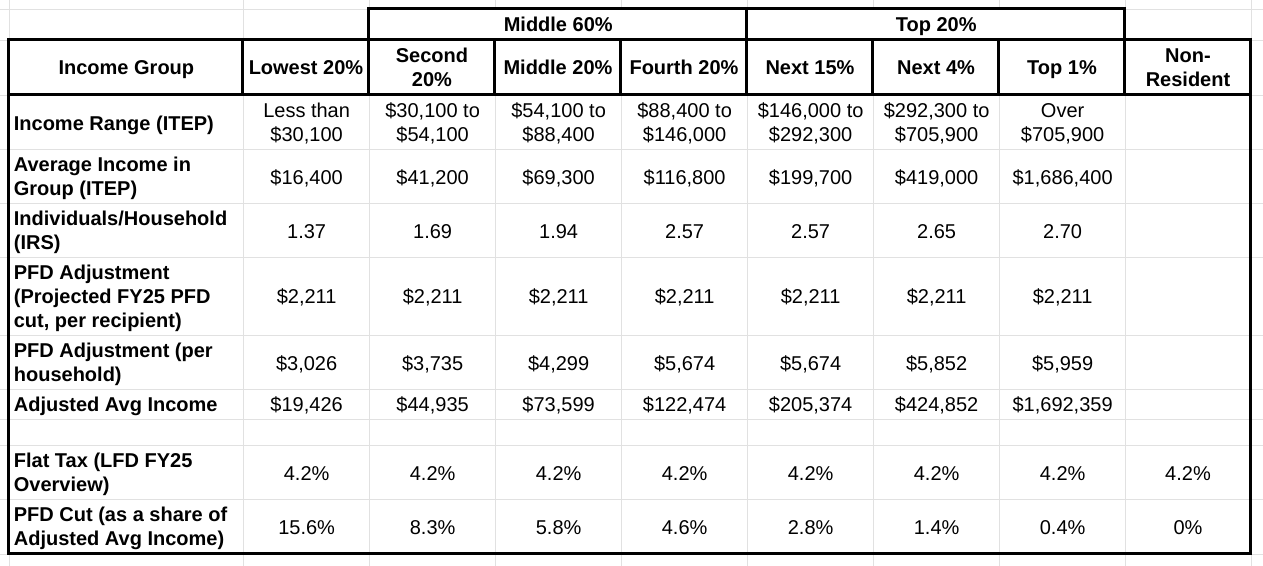

The details underlying the chart are here:

Compared to the overall average of 4.2%, using PFD cuts reduces the income of the average family in the lowest 20% by 15.6%, nearly four times the average, of that in the second 20% (low middle) by 8.3%, double the average, of that in the middle 20% (middle) by 5.8%, more than a third higher than the average, and of that in the fourth 20% (upper middle) by 4.6%, still nearly 10% above the average.

On the other hand, compared to the overall average of 4.2%, using PFD cuts reduces the income of the average family in the “next 15%” (the first increment of the top 20%) by only 2.8%, of that in the “next 4%” (the first increment of the top 5%) by only 1.4%, and of that in the top 1% of Alaska families by only 0.4%, not even a tenth of the overall average tax rate and more than 38 times less than the economic impact of using PFD cuts on the average family in the lowest 20%.

And, as former Governor Jay Hammond put it in his seminal book on Alaska fiscal policy, Diapering the Devil, unlike in any other state in the nation, under that approach, non-residents escape “scot-free” from contributing to government costs.

Oil companies also escape scot-free from contributing anything to cover the shortfall in revenues that have built up since the last time oil taxes were adjusted in 2013. With the exception of Hilcorp, which, through a glitch in the oil tax code, contributes at an even lower rate, they continue to contribute at the tax rates established over a decade ago, at levels that even the Dunleavy Administration at one point, in an apparently unguarded moment, effectively admitted are well below the “revenue-maximizing” level contemplated by the Alaska Constitution.

Thus, contrary to Bradner’s claims, the Legislature’s FY25 budget neither budgets “according to the funds available” nor “works” well for the vast majority of Alaska families, whose well-being should be at the center of the Legislature’s efforts. Rather than reporting those facts, all that Bradner’s piece does is propagandize for an approach that benefits the top 20%, non-residents, and the oil companies at the expense of the remainder of Alaska families.

Some regularly seek to overlook that result by arguing that the approach is acceptable as long as the diverted funds are used for “needed public services.”

But that conflates two entirely separate and distinct issues. The first is what programs should be included in the budget and what the resulting overall spending levels should be. In most states, that’s referred to as the spending or appropriations issue.

The second issue, which is at the heart of both the ISER 2016 and 2017 reports and the 2017 report by the Institute on Taxation and Economic Policy (ITEP), concerns how, once that spending level is set, it should be paid for or put more directly, who should pay for it. In most states, that’s referred to as the revenue (or at the federal House level, “ways and means”) issue.

Attempting to excuse a very bad revenue result for middle and lower-income Alaska families based on what programs are included or excluded from the spending levels is just that: excusing a bad result. Each issue should be addressed separately on its own merits. An acceptable result on one issue doesn’t excuse a bad result on the other.

Using highly regressive PFD cuts – what Professor Berman refers to as the “most regressive tax ever proposed” – to fund spending hugely benefits the top 20%, non-residents, and the oil companies at the expense of the middle and lower-income – the remaining 80% of – Alaska families. On the other hand, using more neutral approaches – particularly a flat tax based on the average impact of the desired revenue level on Alaska adjusted gross income – takes no more from the top 20% and non-residents than it takes from any other Alaska family and, in fact, takes less from the top 20% and non-residents than PFD cuts take from the remaining 80%.

It’s certainly a much more equitable result, with a corresponding lower impact result on the overall Alaska economy, than using PFD cuts. Borrowing Bradner’s term, it “works” for the vast majority of Alaska families rather than against them.

And that should be the goal. Despite Bradner’s and others’ attempts to whitewash their efforts, it’s one this Legislature – particularly its finance committees – failed badly to achieve this past session.