The Friday Alaska Landmine column: Some follow-up on why there is not a Permanent Fund "fiscal crisis"

How the Legislature's inflation-proofing prepayments are giving the Permanent Fund Board time to restore earnings to a level sufficient to support the POMV draw before the shortfalls cause a reduction

In last week’s column, we explained why claims by some that the Permanent Fund is facing a “fiscal crisis” are false.

We explained that contrary to the claims made in a story in the Alaska Beacon – and repeated subsequently in a story in Alaska Public Media – the Permanent Fund’s Earnings Reserve Account (Earnings Reserve) is not in imminent danger of running short of money, and why, contrary to the claims made in an editorial in the Anchorage Daily News, the cause of any issues isn’t “supersized PFDs [Permanent Fund Dividends]” in any event.

Instead, we explained that transfers from the Earnings Reserve to the Permanent Fund corpus (or principal) made in Fiscal Years 2020 and 2022 to “forward fund [prepay] inflation proofing” are the reason why the balance in the Earnings Reserve appears small and that once the impact of the prepayment amounts is included, the balance in the Earnings Reserve is more than adequate currently.

Comments on the column raised a few additional misconceptions about what is occurring with the Permanent Fund accounts. We also have developed some additional thoughts on the issue as we have discussed it with others.

This week’s column focuses on both.

Both misconceptions were raised in the Alaska Landmine comments section. In the first, a commentator claimed that the transfers we described in the column as prepayments for inflation-proofing were made instead “to increase the principal.” In the second, another commentator expressed concern that the $8 billion might be underinvested, achieving a lesser return by being treated as a prepayment.

As to the first, the record clearly reflects that the amounts were appropriated as prepayments of inflation proofing.

The first $4 billion appropriation was made in the Fiscal Year 2020 appropriation bill (HB 39, 31st Legislature). As enrolled, Section 19(j) (p. 64) of that bill reads as follows, explicitly identifying the appropriation as a prepayment:

(j) After the appropriations made in (a) – (i) of this section, the remaining balance of the earnings reserve account (AS 37.13.145), not to exceed $9,400,000,000, is appropriated from the earnings reserve account (AS 37.13.145) to the principal of the Alaska permanent fund. It is the intent of the legislature that the amount appropriated in this subsection

(1) not include associated unrealized gains; and

(2) be used to satisfy the inflation proofing requirement under AS 37.13.145(c) for the next eight fiscal years.

Subsequently, Governor Mike Dunleavy (R – Alaska) line-item vetoed the amount from $9.4 billion to $4 billion but left the remainder of the provision intact, although it was obvious that the remaining amount would not be sufficient to cover “the next eight fiscal years” of inflation proofing. In the Fiscal Year 2022 appropriations bill, the Legislature effectively reversed most of the Governor’s earlier line-item veto, however, appropriating an additional $4 billion from the Earnings Reserve to the Permanent Fund corpus on an ad hoc basis and restoring the cumulative transfer to $8 billion of the original $9.4 billion.

At current rates, that amount is sufficient to fully fund inflation-proofing for a little over six years.

Reflecting HB 39’s language, the Permanent Fund Corporation (PFC) clearly recognized the purpose of the appropriation from the outset. In its June 2019 “History and Projections” report, the first after the appropriation was made, the PFC included a footnote to the $4 billion entry stating, “In FY20, an additional $4 billion was appropriated from the ERA [Earnings Reserve] to principal to forward fund inflation proofing.” To our knowledge, no subsequent legislative language has reversed the stated purpose.

As to the second issue raised in the comments, rather than reducing earnings, the prepayments, in fact, have likely increased the returns earned by the Permanent Fund. In last week’s column, we looked at the accounting for the prepayments from the perspective of the Earnings Reserve. Here is a walkthrough from the perspective of the Permanent Fund principal, beginning from the year in which the first prepayment was made and accounting for the prepayments as used for their intended purpose:

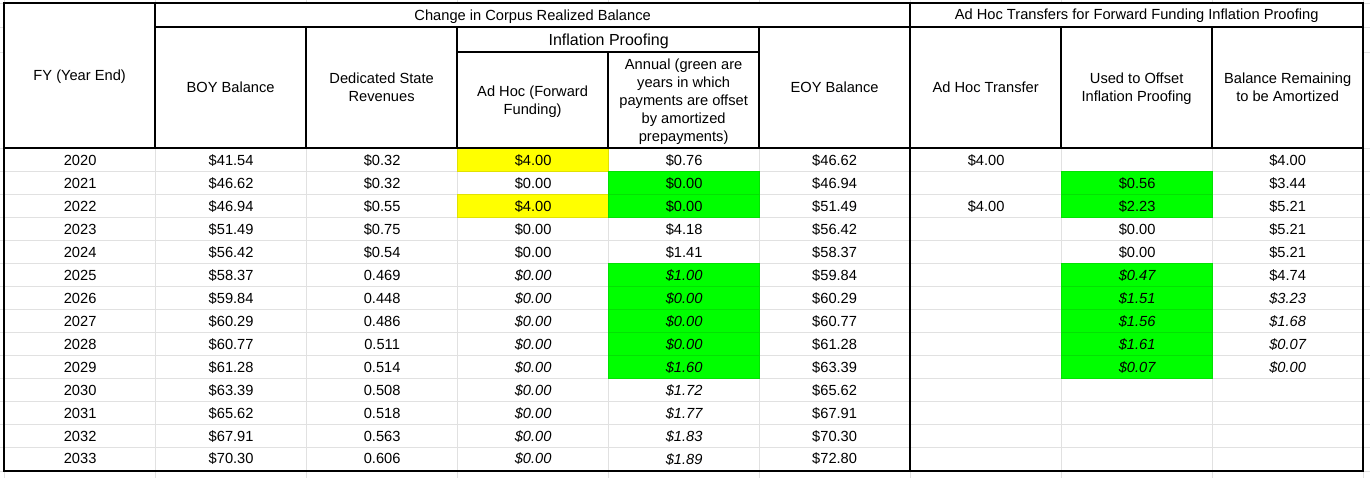

What the prepayments (in yellow) have done is effectively transfer to the Permanent Fund principal the amounts statutorily required to be transferred for inflation-proofing earlier than the statute would otherwise require (the years highlighted in green). Rather than reduce the amount invested as principal, the forward funding, in fact, has increased the size of the principal earlier than anticipated.

We show that effect here. The portion of the chart on the left is the flow of funds into the Permanent Fund corpus, treating the two $4 billion ad hoc deposits as inflation-proofing prepayments. The portion on the right tracks the prepayment balance as it is being amortized over time to offset the annual inflation-proofing payments that would otherwise be required on the annual payment schedule required by statute.

The “Balance Remaining to be Amortized” (far right column) is the portion of the prepayments made for inflation-proofing remaining in the corpus at any given time. To the extent that holding the funds in the principal enables the Permanent Fund to achieve higher returns than if held in the Earnings Reserve, the prepayments have added to Permanent Fund earnings rather than detracted from them.

This chart also shows that rather than using the prepayments to offset annual statutory inflation-proofing payments in consecutive years, the Legislature appropriated – and the Governor approved – additional statutory inflation-proofing payments in FY 2023 and FY 2024. For FY 2025, the Legislature has appropriated – and the Governor has approved – a partial statutory inflation-proofing payment of $1 billion. That does not “short” the Permanent Fund of the difference; the prepayment covers the remainder.

That approach of making additional annual payments in some years rather than drawing down the prepayments to cover inflation-proofing makes sense as long as adequate funds remain in the Earnings Reserve after the additional annual payments are made to meet the Reserve’s ongoing obligations. As was the case with the original prepayments, if there is a surplus of funds in the Earnings Reserve, there is no harm in transferring a portion to the corpus to help both boost short-term returns and serve as a reserve against subsequent unanticipated events.

But those additional transfers should not be made if they put the Earnings Reserve’s ongoing obligations at risk.

The Earnings Reserve serves two critical functions. The first is as a holding account for Permanent Fund earnings before they are transferred either to the Permanent Fund corpus or to the general fund for spending or distribution according to statute.

The second is to serve as a hard stop on efforts to drain money from the Permanent Fund. Under Article 9, Section 15 of the Alaska Constitution, the “principal [of the Permanent Fund] shall be used only for those income-producing investments specifically designated by law for permanent fund investments.” Only funds held in the Earnings Reserve are available for appropriation. Constitutionally, the music stops if the Earnings Reserve is drained; there is nowhere else for the state to go.

As a result, the Earnings Reserve should always be managed to retain an amount sufficient to meet its obligations to the Permanent Fund corpus and the general fund. At current draw rates, that means maintaining an end-of-year balance somewhere in the range of $5.5 billion, less the offsetting impact of any prepayments sitting in the Permanent Fund corpus. Considering the current balance of past prepayments made to the Permanent Fund corpus for inflation proofing, that means a minimum amount currently of somewhere in the range of $4 billion.

According to the Permanent Fund’s preliminary June 30, 2024 Financial Statement, the realized unappropriated balance of the Earnings Reserve as of the end of FY 2024 was $4.3 billion, above the minimum level required, but not by much. Rather than appropriate $1 billion from the Earnings Reserve and draw down $470 million from the prepayment to satisfy the FY 2025 obligation for inflation proofing, it may have been better to reverse those amounts by appropriating $500 million from the Earnings Reserve and drawing down $970 billion from the prepayment balance.

Next year (FY 2026) will present a similar choice. In its June 30, 2024 “History and Projections” report, the Permanent Fund Corporation estimates that the Fund will produce $4.77 billion in earnings during FY 2025. Adopting the remainder of the projections means the Earnings Reserve balance at the end of the year will be around $5.27 billion before inflation-proofing. Covering inflation-proofing fully from the Earnings Reserve would reduce that amount to around $3.8 billion, below the minimum level required to meet its ongoing obligations.

Rather than reducing the Earnings Reserve by that amount, the Legislature, or the Governor through line-item veto if the Legislature fails to do so, once again should cover inflation proofing in part through a contribution from the Earnings Reserve balance and in part through a drawdown of the prepayment balance.

This chart shows the effect if the FY 2026 obligation is split equally between the two. The end-of-year balance remains comfortably above the $4 billion threshold.

As we explained in last week’s column, the remaining prepayment balance is sufficient to continue to protect the Earnings Reserve for an extended period, providing the Permanent Fund with ample opportunity to return to achieving returns at or above the level required to meet the Fund’s objective of “inflation +5%.” There is no need for other actions while a significant prepayment balance remains.

As we also discussed in last week’s column, however, in the event the Permanent Fund is not able to reverse the slide in its recent results to levels below the “inflation +5%” threshold, then the response should be to reduce the portion of the Earnings Reserve transferred to the general fund for spending or distribution according to statute to a level that is sustainable over the long term.

Reducing the transfer in such an event would not be the result of a “fiscal crisis.” It simply would be a recognition that the Permanent Fund Corporation cannot achieve returns sufficient to maintain a 5% percent of market value (POMV) draw over the long term.

In all events, the failure to achieve the target level of returns should not be used as an excuse to combine the Earnings Reserve and Permanent Fund corpus into a single account. As we have explained in previous columns, doing so eliminates the corpus’s protection and, like the Statutory Budget Reserve (SBR), Constitutional Budget Reserve (CBR), and PFD before it, sets it on a path to being drained.

The inflation-proofing prepayments provide a period for the Permanent Fund Corporation to demonstrate that it can restore returns sufficient to support POMV draws at their current level. Hopefully, the Corporation will be able to do so. But if it can’t, the response should be to reduce the amount of the POMV draw, not combine the two accounts to free up a back-door raid on the corpus.