The Friday Alaska Landmine column: Is the fact that legislators live in a much different economic world than 80% of Alaska families leading to deep PFD cuts?

Alaska legislators live in a much different economic world than middle- & lower-income #AKfams. Is that influencing their decision on PFD cuts? We think so. Here's why.

As we have been following the beginning of this session’s budget discussions, we have been puzzling again over why, among the various alternatives, the Alaska Legislature has continued to use cuts in the Permanent Fund Dividend (PFD) as the primary funding source for closing Alaska budget deficits over the past six years.

There are a large number of significant economic reasons why the Legislature should reject using PFD cuts and, instead, use any one – or a combination – of a variety of alternative, lower-impact funding mechanisms. One such reason is that, as researchers from the University of Alaska – Anchorage’s Institute of Social and Economic Research (ISER) advised in a 2016 report, PFD cuts have “the largest adverse impact on the economy” of all of the funding alternatives.

While some sometimes seek to dismiss that finding because of the report’s focus on “short-run impacts,” the fact is the two primary reasons for the finding – that “the PFD cut falls almost exclusively on residents, and it is highly regressive” – are long-term in nature. Neither moderate over time.

While over the longer run, the degrees of difference between PFD cuts and the alternatives, or among the alternatives, might change some, there is little doubt, looking at the fundamental economic significance of those two factors, that PFD cuts would continue to have the “largest adverse impact on the economy” of the alternatives regardless of the period involved.

Tellingly, despite mouthing disagreements with the findings, no one has ever produced a substantive report that concludes differently.

As another report from ISER researchers advised in 2017, PFD cuts are also “by far the costliest measure for Alaska families” of any of the alternatives. And as recently as last year, one of the researchers from the previous ISER reports also reminded Alaskans that “a $1,000 cut will push thousands of Alaska families below the poverty line. It will increase homelessness and food insecurity.” Both also increase government spending levels, worsening the fiscal problems the state faces and leading to a vicious cycle of needing even more funding.

Some have claimed that using PFD cuts saves Alaska money by diverting to state government money that might otherwise go to the federal government through federal taxes. But as we have explained in a previous column, other, broader-based alternatives would raise as much, if not more, money from non-residents than is being saved from the federal government through PFD cuts.

On net, Alaska would have more money, not less, and at a lower overall cost to Alaska families and the economy, from substituting one of those alternatives for PFD cuts.

Then, last week, as legislators and others expressed rising concern about the decline in Alaska’s working-age population, we explained that the state is actually gaining working-age population in the upper-income brackets. The decline is occurring entirely in Alaska’s middle- and lower-income brackets, precisely where the use of PFD cuts as a funding source has an increasingly large adverse impact.

If legislators are as truly concerned as they claim about the overall Alaska economy and Alaska families, all of those factors should lead the Legislature to reject, or at least moderate, the continued use of deep PFD cuts as a funding source and focus instead on one or more of the alternatives.

But they haven’t. So, why is that?

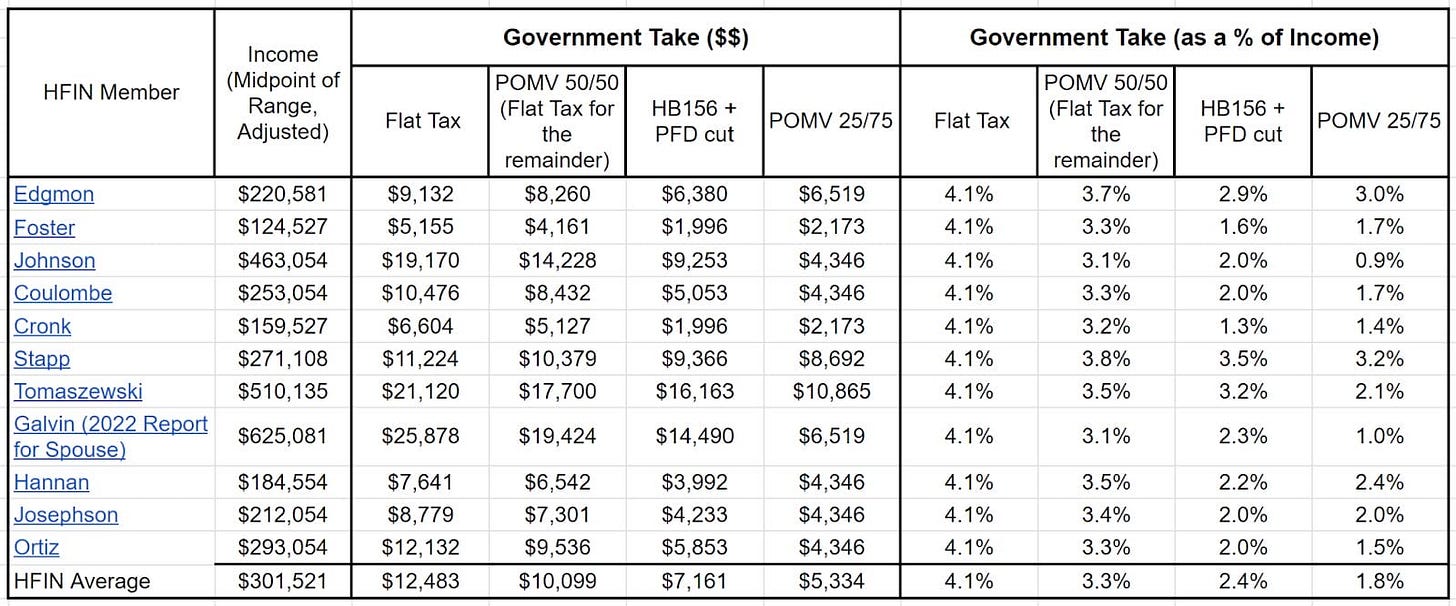

We’ve come to believe that part of the reason is as simple as the fact that the legislators deciding to use PFD cuts don’t feel personally what the 80% of Alaska families living in the middle- and lower-income brackets face. To demonstrate that, this past week, we dug into the impact of various revenue approaches on the members of the House Finance Committee (HFIN) as a microcosm of the Legislature, compared to the impact of the same approaches on middle- and lower-income families.

Using their 2023 Legislative Financial Disclosure filings (the most recent available) as a baseline, we calculated the midpoint of the range in annual income reported by each, adjusted for the impact of the legislative salary increase that took effect at the first of this year and, to evaluate the impact of using cuts in the Permanent Fund Dividend (PFD), a full PFD.

We then looked at the impact of four alternative revenue approaches:

(1) Picking up on a statement in the Legislative Finance Division’s (LFD) most recent “Overview of the Governor’s [FY25 Budget] Request,” a flat rate “individual income tax based on [a fixed percent of] AGI (adjusted gross income), with no exemptions or deductions.”

(2) POMV (percent of market value) 50/50. Because that approach does not raise the full revenue requirement (more on that in a moment), we use the flat tax approach referenced above to raise the remainder.

(3) Representative Alyse Galvin’s (I – Anchorage) HB 156 (2% tax on incomes above $200,000, plus a small head tax). Because that approach also does not raise the full revenue requirement, we use PFD cuts to raise the remainder.

(4) POMV 25/75.

In performing the analysis, we designed each approach to raise $1.38 billion, the expected amount of the FY 25 PFD cut resulting from using the POMV 25/75 approach. We have used that as the overall revenue requirement because it is both the Senate’s targeted approach for raising supplemental revenue as well as what, while listening to HFIN’s review of the Dunleavy administration’s proposed budget, knowledgable reporter Matt Buxton recently “prognosticated” is likely also to become HFIN’s approach this coming year.

To raise that level in the first approach, we used a flat tax rate of 4.1%, based on LFD’s estimate that “an individual income tax based on 3% of AGI, with no exemptions or deductions, would generate roughly $1 billion in the first full year administered.” Scaling up the estimate to a revenue requirement of $1.38 billion results in a 4.1% rate.

The POMV 50/50 approach raises $460 million in PFD cuts, leaving a remaining revenue requirement of $920 million ($1.38 billion less $460 million). The remaining portion needs to be raised in other ways; raising it through additional PFD cuts beyond POMV 50/50 would defeat the purpose – it would no longer be POMV 50/50.

As a result, we raised the $920 million remaining revenue requirement instead in our analysis by using the same flat rate tax approach as above. Scaling LFD’s estimated “3% for $1 billion” rule of thumb to the remaining revenue requirement of $920 million results in a supplemental rate of 2.8%.

According to the accompanying fiscal note, HB 156 is projected to raise a high of $130 million over the next five years, leaving a remaining revenue requirement of $1.25 billion ($1.38 billion less $130 million). Consistent with the previous approaches, the remaining portion could be raised either through additional PFD cuts, since the approach isn’t designed to guarantee a level of PFD distributions, or through a flat tax.

In our analysis, we used additional PFD cuts because we anticipate that, notwithstanding the minimalist amount raised, many will argue the Legislature has used up its tolerance for taxes in passing the chimera of HB 156 and that any remaining amounts should continue to be raised through PFD cuts.

Here is the impact on the HFIN members under the various alternatives:

In every instance, the first approach – a flat tax based on LFD’s rule of thumb – takes the most as a share of income from all of the HFIN members. POMV 50/50 – the second approach – takes the second most. The six members with income above $250,000 pay less under POMV 25/75 than they would under the HB 156 approach; the five members with income below $250,000 pay less using the HB 156 approach.

By both majority and on average, however, the committee members pay the least as a share of income using POMV 25/75. That is consistent with the results generally for other Alaska families in the Top 20%.

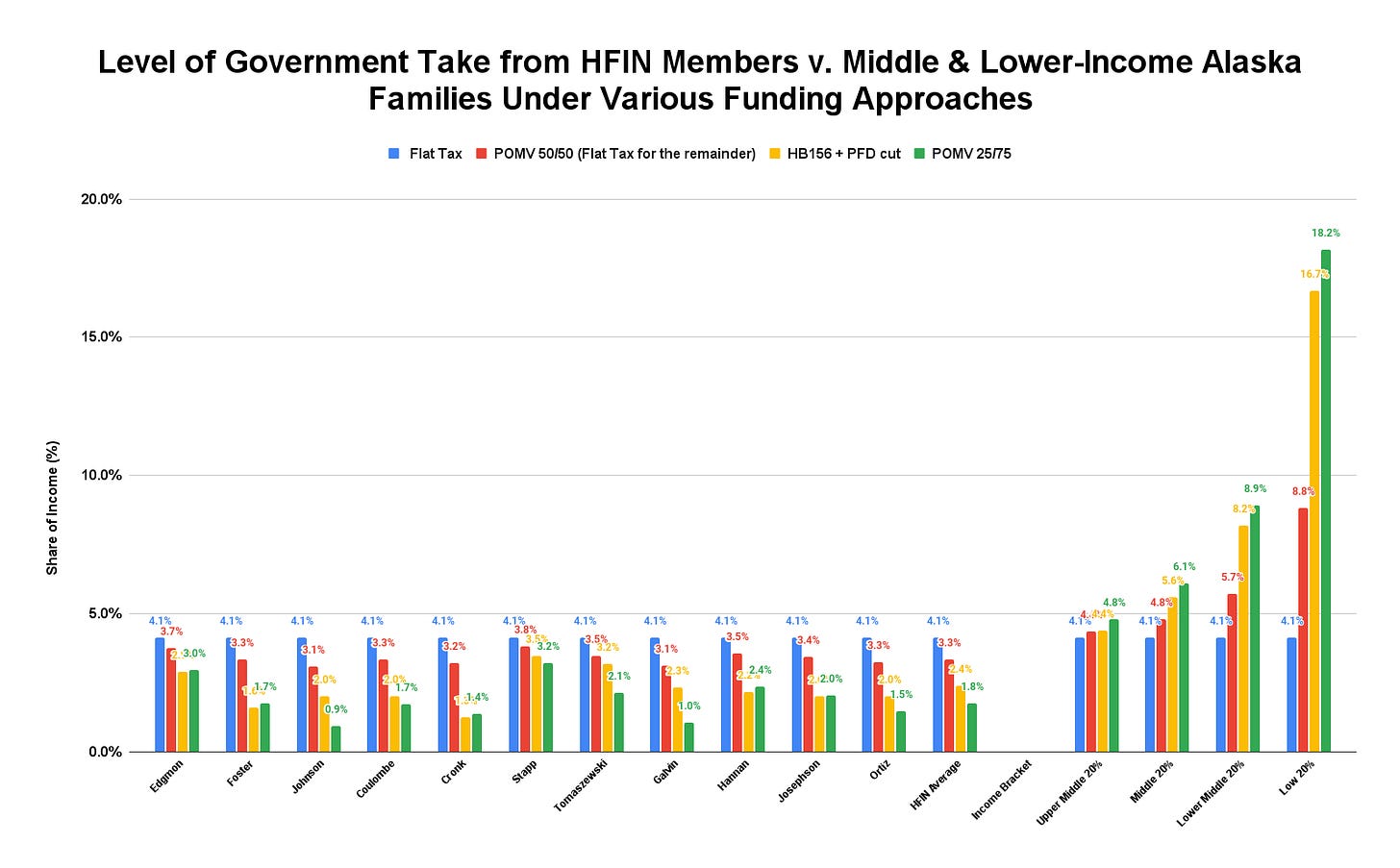

But it is the complete opposite of the results for the 80% of Alaska families living in the middle- and lower-income brackets.

Here are the results for those in those income brackets, using the same approaches as above, with incomes taken as we calculated in a recent column from the Institute on Taxation and Economic Policy’s (ITEP) most recent “Who Pays” report, adjusted for a full PFD.

The first approach (a flat tax) takes the least as a share of income from the 80% of Alaska families living in the middle- and lower-income brackets. POMV 50/50 takes the second lowest – outcomes which are the exact opposite of the results for members of HFIN and others in the Top 20%.

On the other hand, POMV 25/75, the approach that takes the least from the majority of HFIN members and a close second least from the others, takes the most as a share of income from the 80% of Alaska families living in the middle- and lower-income brackets. While Representative Galvin’s HB 156 is effectively a wash with POMV 50/50 for the 20% of Alaska families living in the upper middle-income bracket, it takes the second most by rapidly increasing amounts from the remaining 60% (middle through the Low 20%).

This charts the impact of all of the options across all the members of HFIN and Alaska families living in the middle- and lower-income brackets.

The increasingly larger adverse impact of the options involving PFD cuts on Alaska families living in the middle- and lower-income brackets compared to the HFIN members stands out clearly.

We are not – as some others might looking at these numbers – suggesting that the members of HFIN and the larger House, whose overall income distribution is similar to the members of HFIN, have in the past and continue to cast their votes on fiscal measures based on their own self-interest at the expense of the 80% of Alaska families living in the middle- and lower-income brackets.

We are suggesting, however, that the disparity in income levels makes those in the Legislature much less sensitive to the economic circumstances facing the 80% of Alaska families living in the middle- and lower-income brackets, and that has led to repeated decisions to adopt funding approaches that take more – increasingly much more – as a share of income from the pockets of those living in those income brackets than the legislators have taken from their own pockets.

One additional data point in this regard is to look at the flat tax rate from the perspective of its additional role as the average level of government take from all Alaska families. Those for whom the level of government take is above that rate (4.1%) are paying more than the average, so those for whom the level of government take is lower than that rate can pay less.

Put another way, those paying less than the average rate are enjoying at least a partial “free ride” at the expense of those paying more. Looking at the above charts, it is clear that those Alaska families living in the middle- and lower-income brackets are the ones funding the “free ride.” The members of HFIN, others in the Legislature, and others in Alaska’s Top 20% are the ones enjoying the “free ride” due to the Legislature’s use of PFD cuts as a funding source.

We are sure there are other factors at work in the continued rejection of much more economically beneficial alternatives to the continued use of PFD cuts by this and past legislatures. But we have become convinced that the fact legislators (as well as the donors and lobbyists surrounding them) live in much different economic circumstances than those faced by the 80% of Alaska families living in the middle- and lower-income brackets is playing a significant contributing role.