The Friday Alaska Landmine column: Growth rates

A look at the growth trends in Alaska GDP, spending, and income since 2000, roughly the last quarter century

Occasionally, we check in on the contribution of various sectors to the overall Alaskan economy, where Alaskans are spending their money (and how much), and the level of personal Alaskan income by various measures. Usually, we use the charts available at the St. Louis Federal Reserve Bank’s Federal Reserve Economic Data (FRED) website when we do because it compiles state-level data from various sources in a centralized location and enables the user to present it in several different ways.

This week, we are using FRED to look at the growth rates that various sectors of the Alaska economy have realized since 2000, roughly over the past quarter century, and the growth rates in Alaska expenditures and income over that same period using various measures.

Among the industry sectors, the growth is measured in terms of the increase in Alaska revenue generated by the various sectors, as measured by the federal Department of Commerce’s Bureau of Economic Analysis (BEA), compared to inflation, as measured using the federal Department of Labor’s Bureau of Labor Statistics consumer price index (CPI) for “Urban Alaska” (Anchorage).

Expenditure growth is measured in terms of the increase in Alaska’s personal consumption expenditures (PCE) by various categories, as measured by the BEA, compared to inflation, as measured using the CPI for Urban Alaska.

Income growth is measured in terms of the increase in income reported by the Internal Revenue Service (IRS, adjusted gross income), BEA (personal income), and the federal Department of Commerce’s Census Bureau (personal household and adjusted gross income), again compared to inflation as measured using the CPI for Urban Alaska.

Industry

According to BEA statistics, Alaska’s gross domestic product (GDP) totaled $69.2 billion on an annualized basis as of the end of the first calendar quarter of 2024. The bulk of that – $56.5 billion (82%) – comes from private industries; the remainder comes from what BEA classifies as “Government and government enterprises.”

Within the private sector, seventy-five percent of the total comes from six categories: Transportation, warehousing and utilities (16.1% overall), Mining, quarrying, and oil and gas extraction (14.4%), Finance, insurance, real estate, rental, and leasing (12.3%), Health care, social assistance and educational services (8.7%), Retail trade (5%) and Construction (4.9%).

Government and government enterprises – which at 18.4% of total GDP is the largest sector overall – are composed of three categories: State and local (55% of total government), Military (24%), and Federal civilian (22%).

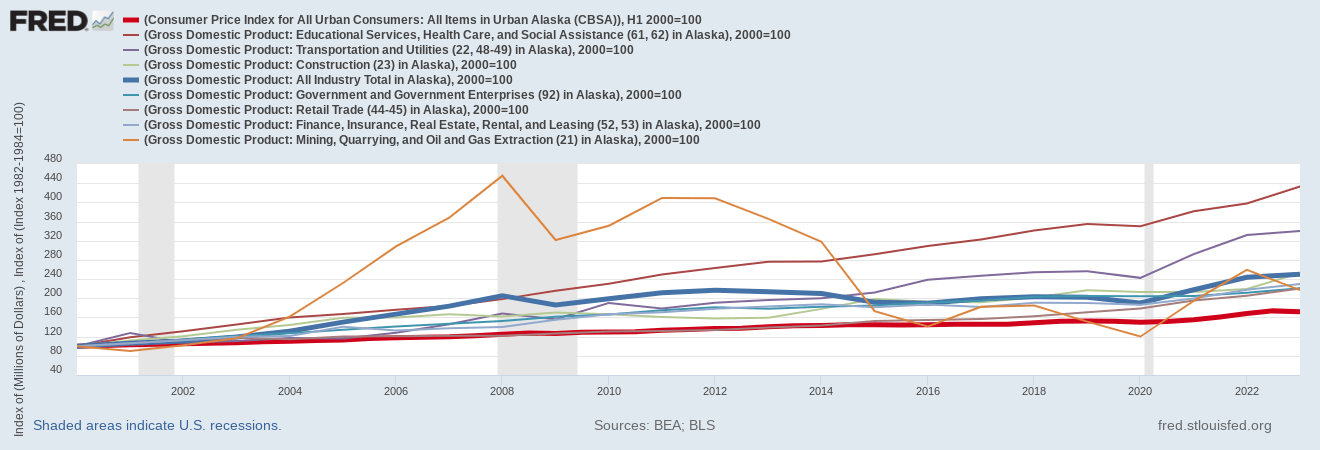

As the following chart reflects, GDP has grown at a compound annual growth rate (CAGR) of 4.1% from 2000 to 2023, 1.7% ahead of inflation (2.4%). Over the period, two of the sectors have experienced growth rates significantly greater than overall GDP. Health care, social assistance, and educational services, now the fourth largest private sector and the fifth overall, have grown at 6.6% annually, and Transportation, warehousing, and utilities, now the largest private sector and the second largest overall, have grown at 5.5% annually.

Construction, now the sixth-largest private sector and the seventh-largest overall, has grown at about the same rate as overall GDP. While still ahead of inflation, Government and the other three of the six largest private sectors – Retail trade, Finance, insurance, real estate, rental and leasing, and Mining, quarrying, and oil and gas extraction – have lagged behind overall GDP growth.

Within the government sector, the Military has grown over the period at 4.9%, ahead of overall GDP. On the other hand, while still ahead of inflation, the State and local government (3.2% CAGR) and Federal civilian (3.1% CAGR) sub-sectors have lagged behind overall GDP.

The following chart traces growth by year for all of the categories. As it shows, growth in most categories has been fairly steady over time at each of their various rates. The stark exception is the Mining, quarrying, and oil and gas extraction sector, which has been highly erratic over the period, reflecting its heavy reliance on similarly erratic oil prices and production volumes.

While the Mining, quarrying, and oil and gas extraction sector clearly drove the rate of overall GDP growth in the first half of the period and still heavily influenced growth in the early half of the 2010s, it has largely been a drag since, even falling below the inflation rate for a brief period in the late 2010s. While the sector’s overall growth rate is now back above inflation, from 2000 through 2023, it has experienced the lowest CAGR over the period of any of the major categories.

Depending on overall production and price levels, the growth rate of the Mining, quarrying, and oil and gas extraction sector may change again as the Willow and Pikka oil projects come online, or it may not.

Regardless, its hugely erratic nature over the period demonstrates why basing the state budget primarily on oil revenues is so problematic. As in virtually every other state, basing the budget on revenues from a broad mix of industries and other sources would produce much more stable and predictable results over time. Alaska’s failure to do so badly misserves both the current and future generations.

Expenditures

According to BEA statistics, Alaska’s personal consumption expenditures (PCE) totaled $43.4 billion for 2022. The bulk of that – $30.4 billion (70%) – was spent on what BEA classifies as “services;” the remaining 30% was spent on goods.

Within services, Health care (20% overall) and Housing and utilities (15.5% overall) represent more than half of services combined. Food services and accommodations (7.8%) and Financial services and insurance (5.15%) are the other major categories.

Within goods, Durable goods (e.g., motor vehicles and parts, furnishings and durable household equipment, and recreational goods and vehicles) constitute 12.7% of overall spending. Food and beverages purchased for off-premises consumption (7.8%) and other Nondurable goods (9.5%) comprise the remainder.

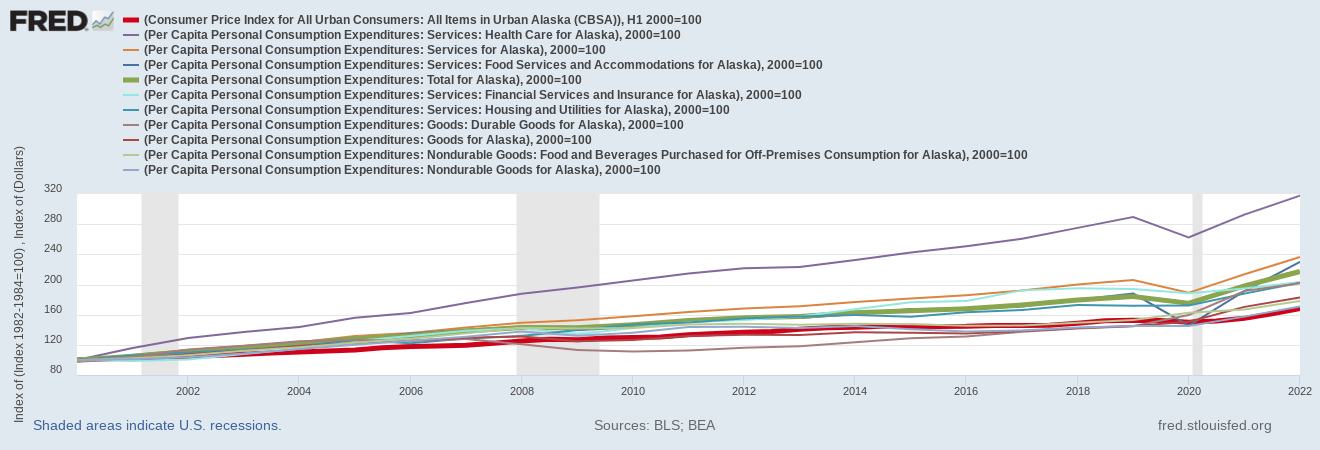

As the following chart shows, overall per capita PCE has grown at a compound annual rate of 3.6% from 2000 to 2022, 1.2% ahead of inflation. Driven mainly by health care, expenditures for services overall have grown by 4% annually. Within services, expenditures for Health care, already the single largest segment of PCE, have experienced the largest growth at 5.4% annually, a rate significantly ahead of overall per capita PCE. At 3.9% annually, expenditures for Food services and accommodations, another sector of services, also have grown faster than per capita PCE generally.

While still ahead of inflation, expenditures in the other major service sectors – Financial services and insurance (3.3%) and Housing and utilities (also 3.3%) – have grown more slowly than per capita PCE overall.

Expenditures for goods have grown slower than per capita PCE overall, although still at a rate higher than inflation. Expenditures for goods overall have grown 2.8% annually, 0.4% above inflation over the same period. Within that category, expenditures for Durable goods have grown at the highest rate, 3.2% annually. Expenditures for Nondurable goods have grown the least at 2.5%, barely 0.1% over inflation. Just slightly above that level, expenditures for Food and beverages purchased for off-premises consumption, the largest segment of the goods sector, have grown only 2.7% annually.

The following chart reflects the growth rate by year for all of the categories. As with GDP, growth in most of the per capita PCE categories has been fairly steady over time at each of their various rates. While expenditures for Health care and Food service and accommodations took a significant dip during COVID, both bounced back relatively quickly and have since resumed significant growth rates.

Income

According to state-level Internal Revenue Service data, Alaska’s adjusted gross income totaled $29.3 billion in calendar year 2021. The bulk of that – $18.4 billion (62.6%) – came from salaries and wages. Other significant shares came from Taxable pensions and annuities (8.6%), Net capital gains (also 8.6%), and Partnership and S-corporation net income (6.5%).

As reflected in the following chart, total Alaska AGI has grown overall at a compound rate of 3.4% annually from 2000 to 2021, 1.3% ahead of inflation. Within that, Net income from a combination of Business or professional net income and Partnership and S-corporation net income has grown at a compound rate of 7.6%, Taxable IRA distributions have grown at a compound rate of 7.5%, Net capital gains have grown at a compound rate of 5.4%, and Taxable pensions and annuities at a compound rate of 4.9%.

While still ahead of inflation, Income from dividends has only risen at a compound rate of 3.1%, and Salaries and wages, by far the largest segment of income at both the beginning and end of the period, have only risen 3%, only 0.8% ahead of inflation. While a small share of overall income, Taxable interest has dropped at a compound rate of 3.3% annually.

While the IRS data largely looks at the amounts at an aggregated level, both BEA and the Census Bureau look at income data on a per capita and household basis. The difference is revealing.

Looking at the BEA data, per capita (mean) personal income has increased 3.6% over the period, 1.5% above inflation, not surprisingly at roughly the same rate as PCE, BEA”s measure of personal spending.

Using the Census Bureau’s measures of household and adjusted gross income (the latter of which the Census Bureau derives from IRS data) produces a somewhat different perspective, however. While Median household income, which is largely calculated by the Census Bureau using BEA data, has risen, the growth rate (3%) is within a percentage point of inflation.

Likely driven by the impact of low growth for salaries and wages, the growth rates for adjusted gross income reported by the Census Bureau based on IRS data are even tighter. The Census Bureau’s measure of income growth over the period using Mean (average) adjusted gross income (2.3%) is only 0.2% above inflation. The Census Bureau’s measure of growth over the period using Median (midpoint) adjusted gross income (1.9%) is actually below inflation by 0.2%.

As the following chart indicates, while two of the three are slightly higher now, all three of the Mean and Median adjusted gross income and Median household income measures have spent almost all of the past quarter century at growth rates materially below inflation.

At first blush, we believe this indicates that while the overall Alaska economy, as measured by GDP, and the costs of living, as measured by PCE, are steadily growing faster than the rate of inflation, average Alaska-adjusted gross income, at least as measured by the IRS and Census Bureau, is stagnating, if not dropping on a real (after inflation) basis. As we have outlined in other ways in previous columns, that phenomenon could help explain some of the net-out migration Alaska is currently experiencing.

For now, however, the purpose of this column is simply to outline the data. We will explore its implications more deeply in future columns.

Another great informative release