The Friday Alaska Landmine column: Are state policymakers really concerned about working age Alaska families? The evidence suggests not

PFDs soften the high cost of living for middle & lower-income working-age Alaska families. PFDcuts pull that rug out from underneath them.

It is no secret that Alaskans face a higher cost of living than in the United States generally.

The U.S. Bureau of Economic Analysis (BEA) regularly prepares an analysis of annual per capita personal consumption expenditures (PCE) by state, which makes that clear. Here is a chart prepared from the PCE data that compares the annual average per capita Alaska PCE (in blue) to the annual US overall average (red) since 1997. Per capita Alaska PCE consistently has run higher than the US average throughout the entire period.

For 2022, the latest year for which data is currently available, the US annual average per capita PCE was $52,542, while Alaska’s was $59,179, 12.6% higher. The difference remains in the double digits throughout the period. The widest difference over the period occurred in 2011, when Alaska’s was 21% higher than the US average. The most narrow occurred in 2021, when Alaska was “only” 11.5% higher. The average difference over the period is 16.5%.

Other studies reach the same general conclusion. In the most recent July 2024 issue of Alaska Economic Trends published by the Department of Labor and Workforce Development, author Gunnar Schultz examines various other measures, all of which reach the same conclusion: while not at the top, Alaska ranks among the most expensive states to live in the nation.

But there are some offsets. The July 2023 issue of Alaska Economic Trends discusses one in the context of one of the studies: “Because the survey does not include taxes, they don’t factor into this comparison — but Alaska is the only state with no state income or sales tax, which gives residents a rare cost-of-living advantage over other states.”

Because the studies focus on costs, they also miss another, even more, significant offset, at least for middle and lower-income – which combined are 80% of – Alaska families: Permanent Fund Dividends (PFD). As the 2017 Institute of Taxation and Economic Policy (ITEP) study for the then-Legislature showed, PFD cuts have a larger impact on families in those brackets than other taxes. Put conversely, PFDs do more to offset the higher cost of living the vast majority of Alaskans face than does the absence of taxes. We looked at that issue in more depth in a previous column.

Using the above chart as a base, here is the effect of the PFD on annual average per capita Alaska PCE:

The blue and red lines are the same as in the previous chart – the annual Alaska average per capita PCE is in blue, and the US annual average is in red.

We have added two more. To show the beneficial impact of PFDs, the dashed blue line is the annual Alaska average per capita PCE after deducting the PFD. From 2016 forward, the dashed blue line uses the PFD as paid, and the dashed green line uses the statutory PFD. The amount of the PFD as paid is from the PFD Division. The statutory PFD comes from our previous analysis.

As is clear, the PFD has helped soften Alaska’s high cost of living materially. From 1997 to 2015, on average, the PFD reduced the cost-of-living difference as measured by the PCE by nearly 30%, from a 17.4% difference before the PFD to 12.4% after. While it did not equalize Alaska’s cost of living with the US overall, it did make Alaska materially more affordable for those living here.

From 2016 forward, the PFD as paid has had a somewhat smaller effect. From 2016 to 2022, on average, the PFD reduced the cost of living as measured by the PCE by approximately 23%, from a 14% difference before the PFD to 11% after.

The effect would have been much more significant, however, if the PFD had been paid as provided by statute. On average, the PFD would have reduced the cost of living over the period as measured by the PCE by approximately 50%, from a 14% difference before the PFD to 7% after, among other things, significantly softening the impact of inflation over that period on Alaska families.

Some argue that Alaska families received the benefit of the PFD cut in another way: by using the PFD cuts to increase government spending over the period.

But that argument misses the important part of the story.

Alaskans may (or may not) have benefited from additional government services, but that’s not the important question from the perspective of Alaska’s high cost of living. The important question – especially in the context of its impact on the cost of living differential – is who paid for the benefit.

As we’ve explained previously in these columns, by using PFD cuts, the burden has been pushed mainly to middle and lower-income Alaska families. Those in the top 20% have contributed a trivial share of their income, and non-residents and oil nothing toward the additional spending.

To borrow a phrase from former Governor Jay Hammond, middle and lower-income Alaska families – those most affected by Alaska’s higher cost of living – have ended up covering the bulk of the costs, increasing the impact of the higher cost of living from where they would have been at a full PFD, while those in the top 20%, non-residents, and oil companies, those least affected by the higher cost of living, have escaped virtually “scot-free.”

For those claiming to focus on softening the impact of the higher cost of living on middle and lower-income – working-class – Alaska families, it’s hard to imagine a more self-defeating fiscal policy.

Some argue Alaska’s higher cost of living is a significant contributor to the current and continuing net out-migration of the state’s working-age population, a development that the state’s politicians nearly universally bemoan. We agree with this concern.

The huge irony is that it’s the very same politicians that are making it worse.

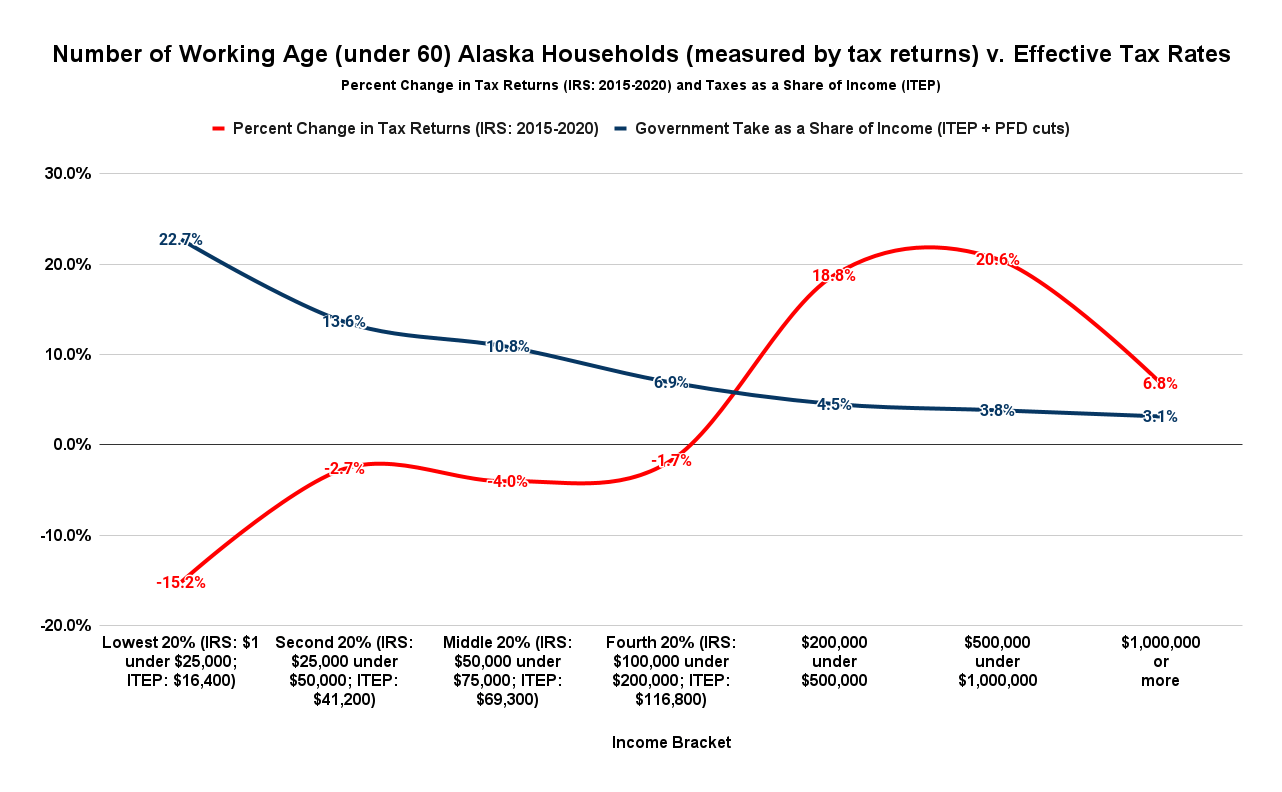

As we’ve explained in previous columns, the net out-migration of the working-age population is almost entirely made up of Alaskans in the middle and lower-income brackets. A chart from our previous column drives home the point.

Using Internal Revenue Service (IRS) data, the chart tracks, by income bracket, which households headed by someone below age 60 are in decline (red) and which are increasing (blue) over the period from 2015 to 2020. The results are clear. Among those headed by someone below 60 – in other words, working-age Alaskans – households with incomes under $200,000 are in decline, while those with incomes above that level are, in fact, growing.

As another graph from that column shows, the overlaps are clear. Those who would benefit most from maintaining full PFDs and using other, more equitable, and lower-impact means to raise the revenues necessary to fund state government are leaving. Those who, economically, are largely indifferent to the PFD are staying.

By using PFD cuts to fund government services, Alaska’s politicians are helping to drive working-age Alaskan families out of the state, not making their lives better.

In short, despite their claims of concern, by voting to use PFD cuts, the politicians are pulling an important economic rug out from underneath those very families about whom they profess to be most concerned. Those in the top 20% – those least affected by the higher cost of living and the segment of the population that is not only staying but growing – retain theirs.

What explains that? As we’ve discussed in a previous column, despite the negative impact it has on working Alaska families, perhaps it’s the fact that the politicians – all of whom now fall into the top 20% as a result of their recent pay raise – benefit personally from using PFD cuts to fund the government. So do their major donors. It stands out as a prime example of the self-serving use (or, is the better word, abuse) of legislative power.

Perhaps it’s something else. This isn’t the only area in which Alaska politicians say one thing and do another, and it’s not even the only one in which they are pushing self-defeating policies. But given the significant problems being created by the impact of Alaska’s high cost of living on net out-migration, it certainly is one of the most important.

It makes us conclude that while the state’s politicians say they are concerned about the out-migration of working-age Alaska families, they actually aren’t.