The Friday Alaska Landmine column: Is the current Permanent Fund Board chaos costing Alaskans money

Is the current chaos surrounding the Permanent Fund Board costing Alaskans money? There's evidence in the Permanent Fund Corporation's performance reports it is. We explain.

Alaskans who have paid even cursory attention to local news in the recent past will likely have noticed repeated negative headlines about the Permanent Fund Board. The headlines began in late 2021 with the removal of then-Permanent Fund Executive Director Angela Rodell and were followed the next year with stories about the subsequent legislative investigation into the removal. Those were then followed in 2023 with the sudden, and still largely unexplained, departure of widely-respected Chief Operating Officer Mike Barnhill.

Also in 2023, the Permanent Fund Board announced that it was finally halting further investments into a fund initially created in 2018 devoted to investing in in-state businesses, a program which was a significant departure from the Fund’s previous practice and a development that was followed soon thereafter by reports of how badly at least one of those investments was turning out. Those stories have shared news space more recently also with those related to an extended back and forth between the Board and the Legislature over the Board’s decision to establish an Anchorage office.

Most recently, even more attention has been focused on leaked internal Permanent Fund staff emails alleging ethical lapses by Board member Ellie Rubenstein and, now, the Board’s subsequent investigation into how the emails became public.

That has even led to a less-than-favorable article in the London-based, preeminent international financial publication, the Financial Times, in which the Board was described unflatteringly, given its significant financial role, as “a six-person board comprised mainly of financial laymen.”

But aside from being an embarrassing and concerning trend, we have wondered whether the chaos is having a more tangible, immediate impact on Alaskans. In short, is it costing Alaskans money (in addition to the lawyers’ fees for dealing with the chaos)?

To evaluate, we have examined the Permanent Fund Corporation’s (PFC) annual and monthly performance reports to determine the extent to which it is meeting its financial objectives.

Since Fiscal Year (FY) 2017, the performance reports have measured the Permanent Fund’s overall performance against three benchmarks: the “Passive Index Benchmark,” the “Performance Benchmark,” and the “Total Fund Return Objective.” The PFC’s FY 2023 Annual Report describes those three benchmarks as follows:

PASSIVE INDEX BENCHMARK: VALUE ADD This short-term performance indicator is based on a blend of passive indices reflective of a traditional portfolio consisting of public equities, fixed income, and real estate investments. The objective is to earn regularized income to support the liquidity needs of the Fund while outperforming a passive global index portfolio of stocks, bonds, REITs, and US TIPs.

PERFORMANCE BENCHMARK: PEER COMPARISON This indicator is a blend of indices covering all asset classes, reflective of the Fund’s target asset allocation.

TOTAL FUND RETURN OBJECTIVE 5%: REAL RETURN The long-term investment goal is to achieve an average real rate of return of 5% per year (CPI/inflation +5%) at risk levels consistent with large public and private funds.

The third benchmark – the “Total Fund Return Objective 5%” – is especially important because it measures whether the Permanent Fund is achieving the 5% “real” (after-inflation) return embedded in AS 37.13.140(b), the statute governing the calculation of the Legislature’s annual percent-of-market value (POMV) draw. If the Permanent Fund fails to achieve that objective on a consistent basis, continuing the POMV draw at that level gradually will erode the value of the Fund.

The publicly accessible monthly performance reports measure the Permanent Fund’s overall performance against those three objectives using 5-, 3-, and 1-year rolling averages. The longer averages provide a longer-term perspective that looks past the significant variability that may occur in a one-year measure.

In our review, we have examined the Permanent Fund’s performance against each of those benchmarks using each of the time periods as of the end of each fiscal year since the current benchmarks were adopted in 2017. For FY 2024, we have examined the Permanent Fund’s performance against each of the benchmarks using each of the time periods as of the most recent month for which data is publicly available (April 2024). Those reports calculate the relevant rolling averages as of April 30, 2024.

We have included the measure for FY 2024 because the chaos surrounding the Permanent Fund Board has intensified over that period. Thus, results from that period are useful for evaluating whether there are any recent changes to the Permanent Fund’s performance as a consequence.

Here are the results using the 5-year rolling averages.

The percentages are the difference between the “Total Fund” return actually earned by the Permanent Fund over the period on a 5-year rolling average and the comparable return over the same time period for the benchmarks. For example, here are the raw numbers from the monthly performance report for June 2023, the end of FY 2023.

The returns for the “Total Fund” and each of the benchmarks for each of the time periods (5-years, 3-years, and 1-year) are shown in the columns to the right of the page.

For purposes of the 5-year chart, we calculated the difference between the “Total Fund” and the performance of each of the three benchmarks in the column headed “5 Years” to reflect the overall fund’s performance against each benchmark over the 5-year time period. For example, the Total Fund’s performance compared to the Passive Index Benchmark over the previous five years is the difference between 7.93% (Total Fund) and 4.98% (Passive Index Benchmark), or plus 2.95%. A positive (plus) result indicates the Permanent Fund outperformed the benchmark.

On the other hand, the Total Fund’s performance compared to the Total Fund Return Objective over the same period is the difference between 7.93% (Total Fund) and 8.91% (Total Fund Return Objective), or minus 0.98%. A minus indicates that the Permanent Fund’s performance fell short of (underperformed) the benchmark.

While there is variability over the period, the results in our 5-year chart generally show the Permanent Fund’s rolling 5-year results outperforming all three benchmarks from FY 2017, when the current benchmarks were adopted, through FY 2023. While there were two years when the Permanent Fund’s actual results calculated on a rolling 5-year average fell below the results for the Total Fund Return Objective, the Permanent Fund’s actual rolling 5-year averages over the period outperformed the results for the other two benchmarks throughout the entire period.

On average, over that time period, the Permanent Fund’s rolling 5-year results outperformed the Passive Index by 2.35%, the Performance Benchmark by 0.89%, and the Total Fund Return Objective by 1.33%.

While generally not as strong as the average results over the previous seven years, the rolling 5-year results for the period ending April 30, 2024, the most recent month for which a report is available, remain mostly positive. As of the most recent report, the Permanent Fund’s rolling 5-year results continue to outperform two of the benchmarks – the Passive Index and the Performance Benchmark.

Continuing a trend that generally dates back to FY 2020, however, the Permanent Fund’s actual 5-year results for the period ending April 30, 2024, are underwater when compared to the Total Fund Return Objective. We will discuss the concerns that – and similar results over other periods – raise in greater detail later in this column.

The comparisons using the rolling 3-year results are roughly the same as the rolling 5-year results when looking at the average over the period from FY 2017 through FY 2023. The average of the Permanent Fund’s rolling 3-year results for that period is positive across all three benchmarks at levels comparable to the average for the rolling 5-year results over the period.

The rolling 3-year results for the period ending in FY 2024 are significantly different, however. As of the most recent report, the 3-year results for the Permanent Fund are underperforming the comparable 3-year results for two of the benchmarks – the Passive Index and the Total Fund Return Objective – and only barely outperforming the third.

More importantly, the most recent rolling 3-year results show that the Permanent Fund’s actual results are significantly underwater (as of the end of April 2024, by 6.5%) compared to the Total Fund Return Objective. As noted previously, that’s particularly important because that benchmark measures the Fund’s performance against the level of the Legislature’s annual POMV draw. Sustained negative performance against that benchmark is an early indication that the Permanent Fund may be unable to continue to generate sufficient funds to meet the POMV draw. Again, we will discuss that issue in greater detail later in this column.

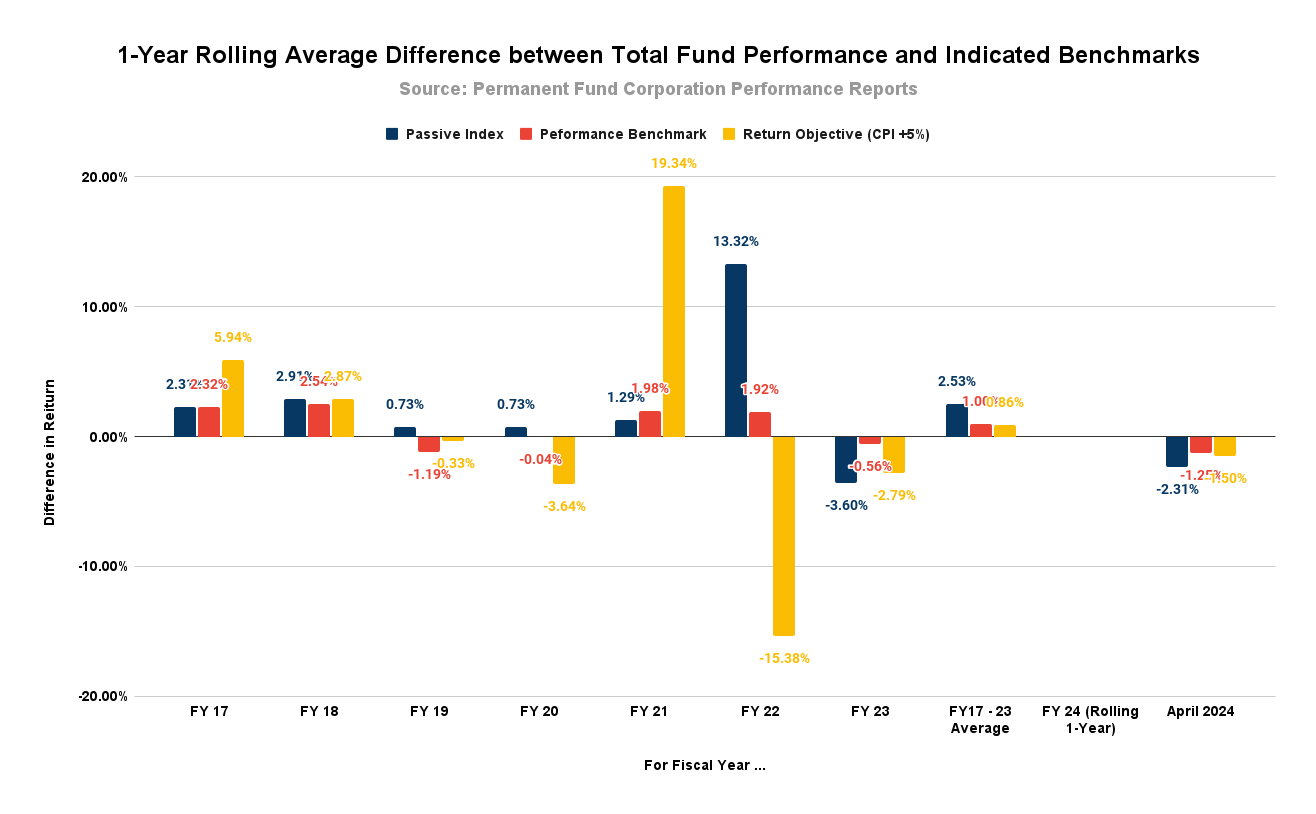

The comparisons using the rolling 1-year results are roughly the same as the 3-year and 5-year when looking at the average over the period from FY 2017 through FY 2023. While there is significantly more annual variability, the Permanent Fund’s average results over the period remain positive across all three benchmarks at levels comparable to the average for the rolling 5-year and 3-year results over the period.

Unlike the comparable 5-year and 3-year results, however, the rolling 1-year results for the periods ending in FY 2024 are generally troubling. In the most recent report, the rolling 1-year results for the Permanent Fund are underperforming the comparable rolling 1-year results for all three of the benchmarks by material amounts. While the Permanent Fund’s performance compared to that of the Total Fund Return Objective is better than the most recent comparison of the 5-year and 3-year results, it’s still underwater by more than 1% (or more than 20% of the target 5% return).

The Permanent Fund’s rolling 1-year performance in the recent report compared to the other two benchmarks – the Passive Index and the Performance Benchmark – is significantly worse than those in the 5-year and 3-year reports.

This seems to suggest that the Permanent Fund’s performance over the past year, when judged against the benchmarks that the Board itself has developed, is deteriorating. Put another way, the Permanent Fund appears increasingly to be leaving money on the table compared to the results from the benchmarks it has set for itself.

The fact that this has occurred over the same period that the chaos surrounding the Permanent Fund Board has intensified creates a significant question about whether the second is leading to the first. If the Board is taking its eye off the ball on the things that matter to deal with its mostly self-inflicted chaos, then the answer to the question we posed at the beginning of this column – is the current Permanent Fund Board chaos costing Alaskans money – is likely yes.

While not an entirely recent development, we are particularly concerned about the continuing trendline relating to the Permanent Fund’s actual performance compared to the Total Fund Return Objective. In this chart we have isolated the Permanent Fund’s rolling 5-, 3- and 1-year performance against the Total Fund Return Objective, the same standard used in the calculation of the POMV.

With the exception of FY 2021, the Permanent Fund's actual performance on all three measures - 5-year, 3-year, and 1-year rolling average - has been underwater compared to the Total Fund Return Objective every year since FY 2020 (and on a 1-year basis, back to FY 2019). The most recent results indicate that this remains the case in FY 2024.

Given the link between the Permanent Fund’s performance against that measure and the POMV draw, those results should have long since triggered an intense focus by the Permanent Fund Board either on corrective measures or, if the goal has become unachievable, advising the Legislature of that fact so that the Legislature can reconsider the statutory draw level.

Given its continuation, however, we have to wonder whether the Board is taking its eye off the balls on which it should be focused in order to chase the various other activities - the dismissal of Angela Rodell, the loss of Mike Barnhill, setting up then closing down the program for in-state investments, opening an Anchorage office against legislative wishes, dealing with Ellie Rubenstein - that has seemed to consume most its recent attention instead.

Now that we have identified these issues, we intend to continue to track the Permanent Fund’s performance against these benchmarks - and, potentially, others as we continue to think through the issues - in an ongoing series of regular charts we will update monthly as the PFC publishes its results.

Hopefully, that will help Alaskans determine for themselves whether, as a result of the largely self-generated chaos surrounding it, the Permanent Fund Board - again, to quote the Financial Times, “a six-person board comprised mainly of financial laymen” - is costing Alaskans money. We believe the recent evidence derived from the performance measures suggests it is.