The Friday Alaska Landmine column: This is brutal

Leg Finance's FY26 overview concludes this coming year's budget likely won't balance even using a 75/25 PFD approach. But that's just the tip of the iceberg. It gets much worse.

Over the past few years, one of the documents we have come to rely on most in assessing Alaska’s fiscal situation is the Legislative Finance Division’s (LFD) annual “Overview of the Governor’s Budget” (Overview). Especially in recent years, the Overview has provided much more accurate and honest assessments of the state’s fiscal situation than its executive branch counterpart, the “10-Year Plan” published by the Administration’s Office of Management and Budget (OMB).

To be clear, LFD’s Overview is not without significant problems. For instance, contrary to LFD’s own fiscal rules, LFD’s Overview treats the annual Permanent Fund Dividend (PFD) as “unrestricted” rather than “designated” general funds. As reflected most recently in footnote 3 of its “Detailed Fiscal Summary – FY25 and FY26 (Part 1),” LFD’s own fiscal rules explicitly state that “Designated general funds include 1) program receipts that are restricted to the program that generates the receipts and 2) revenue that is statutorily designated for a specific purpose.”

As we’ve explained in previous columns, each year, a discrete and calculable portion of the revenues drawn from the Permanent Fund earnings reserve as part of the annual percent of market value (POMV) draw is “statutorily designated for [the] specific purpose” of being distributed as PFDs. Intentionally ignoring their origin, LFD’s Overview instead classifies the funds as “unrestricted” funds, generally available for general fund spending, rather than, as its own rules require, designated for PFDs.

The effect is to significantly overstate the amount of unrestricted general funds (UGF) available to pay for government spending and, in doing so, significantly understate the amount of the UGF deficits the state has been running. The deceit also masks the amount of the funds explicitly designated for PFD distributions that are being diverted (what Professor Matthew Berman of the University of Alaska – Anchorage’s Institute of Social and Economic Research calls “taxed”) to cover UGF deficits.

However, that sort of deception in the Overview is limited and correctable when using LFD’s numbers. The problems with OMB’s wishful-thinking-based 10-year plans are much more pervasive. In particular, the Overview is much better at projecting future UGF spending levels than the OMB’s 10-year plan.

As a result, we take LFD’s recent warning in this year’s Overview seriously regarding the depth of the state’s fiscal problems. After adjusting the projected spending levels included in OMB’s proposed FY26 budget for the “costs necessary to maintain State services at the same level as FY25,” the Overview concludes that the state faces “a substantial deficit in FY26 even with a 75/25 PFD appropriation.”

A chart accompanying the Overview quantifies the immediate problem. There, LFD projects that the Legislature will need to raise an additional $197 million – nearly $200 million – in FY26 just to maintain FY25 service levels.

The “75/25 PFD appropriation,” which reduces the amount appropriated for the PFD from its statutory level to 25% of the POMV draw and diverts (taxes) the remainder to UGF, is the non-statutory, ad hoc approach the Legislature has used to set the PFD over the last few years.

The amounts involved are substantial. For FY25, for example, using the “75/25” rather than the existing statutory approach diverted (taxed) roughly $1.43 billion from the PFD to UGF. The similar number for FY26 is $1.51 billion. At current recipient and administrative cost levels, those diversions (taxes) equal approximately $2,300/PFD, or $6,150/average Alaska household.

In the Overview, however, LFD concludes that even that level of diversion isn’t enough to “balance” the FY26 budget. Instead, “[t]o balance the [FY26] budget” just at FY25 service levels, in addition to the already significant diversion, the Legislature will “need to reduce spending, pass legislation to increase revenue, further reduce the PFD, or draw from savings” to offset the still remaining $197 million deficit.

But that number is just the tip of the iceberg. It doesn’t consider any additional spending increases this Legislature may appropriate for FY26 beyond those necessary to maintain FY25 service levels. Moreover, it’s just a one-year number; it doesn’t reflect the state’s ongoing deficits.

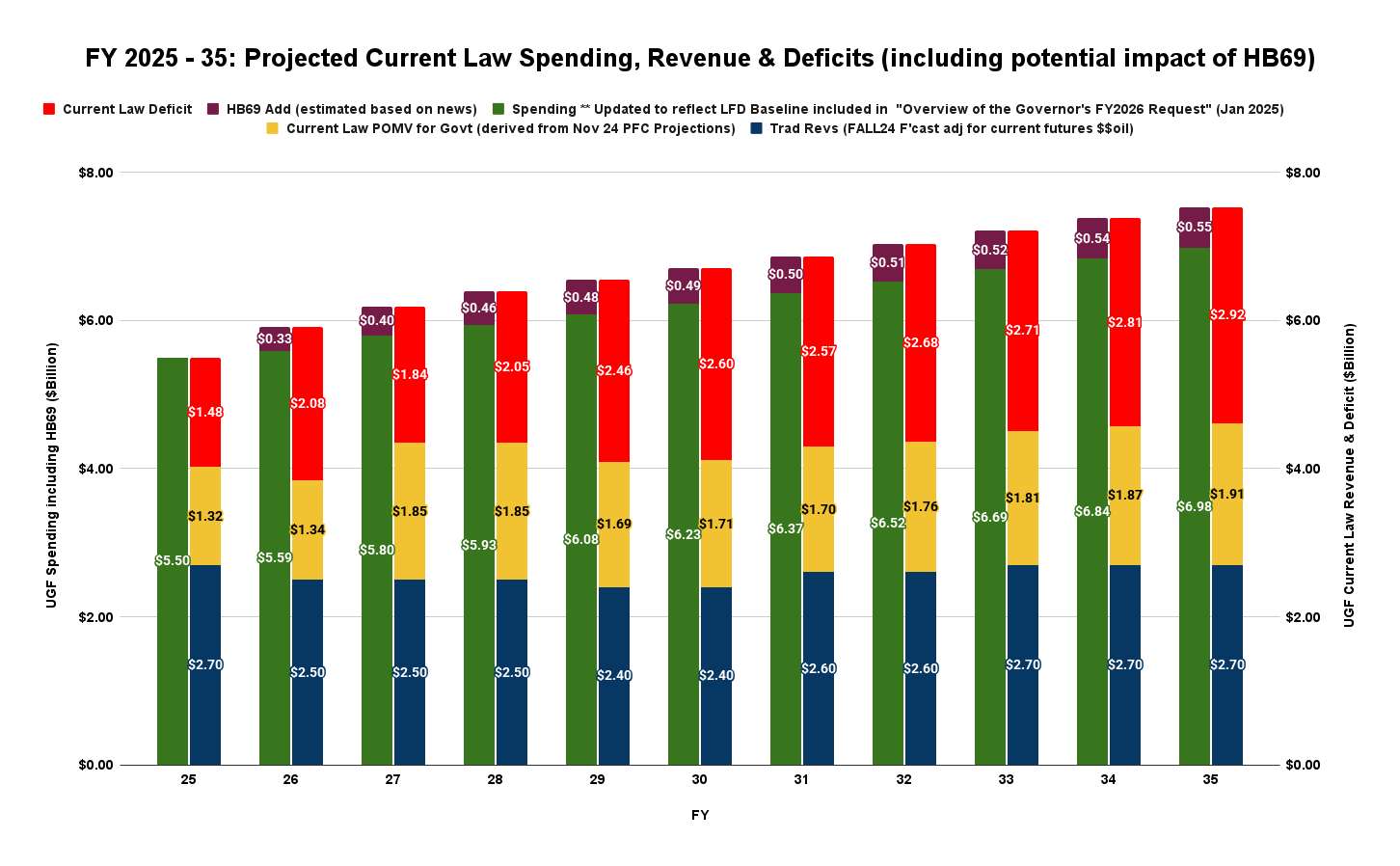

The following chart attempts to outline the full magnitude of the state’s problem over the next ten years. It shows the size of the deficits the state will face going forward based on revenues taken from the Department of Revenue’s Fall 2024 Revenue Forecast, adjusted for the forward price of oil reflected in the current futures market, and spending levels taken from LFD’s “Baseline” included in the Overview.

To reflect the impact of potential increases this Legislature may add on above those necessary to maintain FY25 service levels, the chart also includes an estimate of the fiscal impact of HB 69, the recently introduced bill by Representative Rebecca Himschcoot (I – Sitka) to increase the K-12 “Basic Student Allocation.” We have estimated the cost of HB 69 based on projections included in recent news stories because there is currently (as of the date we are writing this week’s column) no fiscal note for the bill.

Reflecting the combined effect of spending increases and the stagnation in “traditional revenues” over the period, the resulting current law deficits (in red) nearly double, from $1.48 billion in FY25 to $2.92 billion by FY35. And that’s without accounting for any additional spending programs future legislatures may add.

In recent years, previous legislatures have managed the budget deficits they have created by making ad hoc adjustments in the amount appropriated for PFD. This effectively taxes the PFD – and its recipients, primarily middle and lower-income Alaska families – to cover the gap. In recent years, this approach has been reflected in the “75/25 PFD appropriation.”

However, as the Overview notes, even that amount of diversion is no longer sufficient to cover the problem.

The following chart shows the amount of the annual POMV draw that will be required to offset the deficits going forward if not reduced by alternative revenues. The portion required will go from roughly 75% for FY25, to 90% for FY26, to more than 97% by FY35, with the level exceeding 100% in a couple of the intervening years. And, again, that’s without accounting for any additional spending programs that future legislatures may add.

Using the nomenclature adopted by recent Legislatures, under this approach, the portions of the POMV draw going separately to cover UGF spending and the PFD would go from 75/25 in FY25 to 90/10 in FY26, to more than 100/0 in FY29 and 30, before settling at 97/3 in FY35. Assuming roughly the same number of recipients and administrative costs in both years, the individual PFD will decline from the roughly $1,400/recipient distributed in FY25 to approximately $175/recipient in FY35, a staggering reduction of nearly 88% over the period in a material source of income to middle and lower-income Alaska families.

Another way to visualize the size of the deficits useful to some is to express them as a percentage of spending, as a percentage of Alaska AGI (adjusted gross income), and as a percentage of the non-governmental (i.e., private) sector portion of Alaska’s GDP (gross domestic product). Here are those numbers:

As the lines at the top of the chart show, the deficit as a percentage of overall spending grows from roughly 27% in FY25 to nearly 42% by FY35, from about 4.2% of Alaska AGI in FY25 to roughly 6.4% by FY35, and from roughly 2.5% of private sector GDP in FY25 to 3.9% by FY35.

These are huge numbers. The AGI number, for example, reflects the average tax rate the state would need to assess if it were to cover the deficit through an income tax. The GDP number roughly reflects the average tax rate the state would need to assess if it were to cover the deficit through the ultra-broad-based sales tax proposed in the last Legislature’s HB 142.

These numbers tell a brutal story about Alaska’s future. The one-year look reflected in the Overview is bad enough. Even using the “75/25 PFD appropriation,” the state can’t afford to maintain FY25 service levels, much less have any leftover to cover the costs of any proposed increases.

And that’s just the one-year look.

Beyond that, the state’s near-term fiscal picture is even more bleak. Deficit levels rise to over 40% of spending. To cover that, taxes approaching 6.5% of Alaska AGI become necessary, whether they are designed as PFD cuts or income or sales taxes that spread the burden more equitably and broadly.

If recovered through PFD cuts, the burden will fall hardest on working-age, middle and lower-income Alaskan families, the very segment of Alaska currently driving the state’s outmigration. It will make that problem – which some believe is the state’s most significant challenge – worse.

If recovered more broadly through an income or sales tax, the adverse economic impact on any one segment will be less, but the overall impact will still be noticeable.

Regardless of the approach, covering the deficits transfers an additional huge amount of income from Alaska’s private sector to its government sector. The differences in approach affect who pays or which income brackets are hit hardest, but they won’t affect the overall division between the government and private sectors.

Alaska is facing some very rough fiscal seas ahead. And it’s not very well positioned to protect its residents from the brutal adverse impacts.