The Friday Alaska Landmine column: What would the amount of the PFD have been if the Legislature hadn’t taxed it

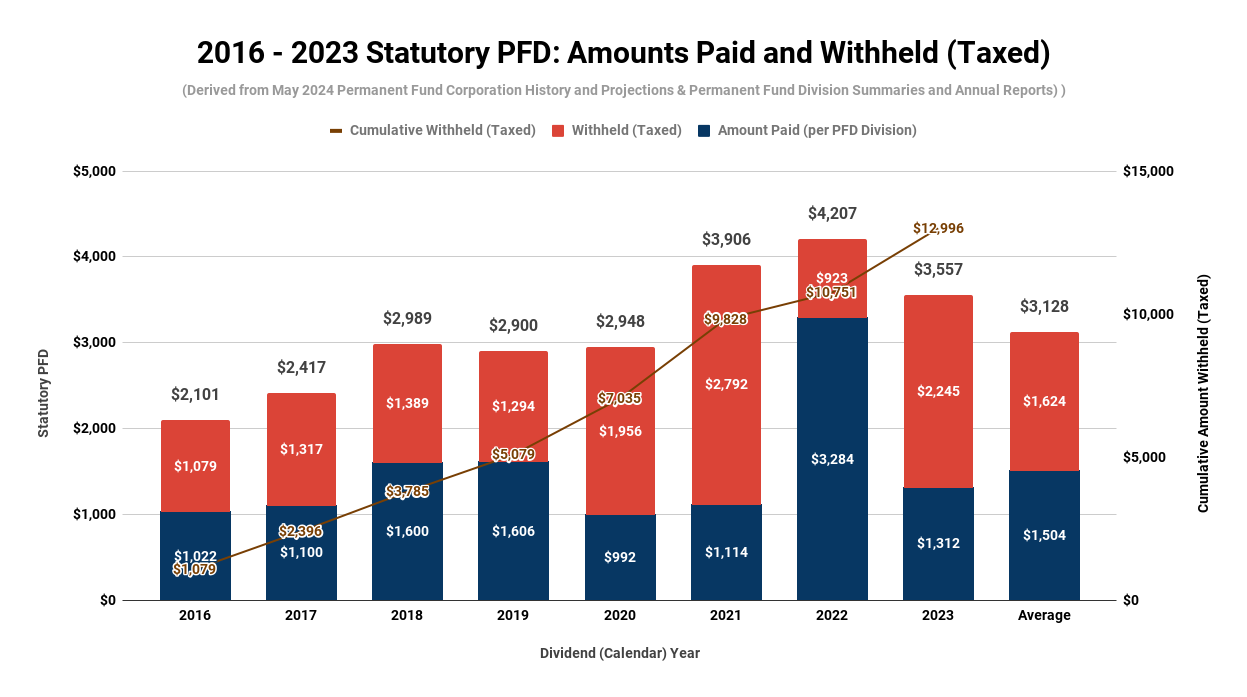

Some routinely ask what past PFDs would have been if the Legislature hadn't taxed (cut) them. This week's chart does the calculations.

Occasionally, we are asked if we know where to find what the amount of the Permanent Fund Dividend (PFD) would have been in any given year if the Legislature (or, in the case of the first year it was cut, then-Governor Bill Walker) had not cut it.

To our knowledge, there is no official government source that calculates and posts the amount on an ongoing basis. Rather, it seems like most, if not all, in the government would like to keep the numbers obscure so that, while interested Alaskans know it happens, they don’t know by how much.

As a result, over time, we have developed a chart we use internally to calculate and keep track of the amounts as part of our ongoing efforts to assess the distributional and other impacts of those taxes on Alaska families and the Alaska economy.

We were asked the question again the other day, so we decided to post our internal chart as this week’s chart of the week so that we and others can use it as a public reference tool as the question arises in the future.

While the concept is simple, the actual calculation is somewhat complex. The formula is spread over two sets of statutes and the information over two government entities. The first set of statutes is AS 37.13.140(a), which governs the calculation of the “income available for distribution,” and the immediately following AS 37.13.145(b), which provides that “At the end of each fiscal year, the [permanent fund] corporation shall transfer from the earnings reserve account to the dividend fund established under AS 43.23.045, 50 percent of the income available for distribution under AS 37.13.140.” The information for those calculations is available from the Permanent Fund Corporation (PFC).

The second is AS 43.23.025, which provides for the calculation of the actual amount to be distributed per PFD. That statute takes the amount transferred pursuant to AS 37.13.145(b), makes a number of adjustments, then divides the result by the “the number of individuals eligible to receive a dividend payment for the current year and the number of estates and successors eligible to receive a dividend payment for the current year under AS 43.23.005(h).” The result is the statutory amount due for that year. The information for those calculations is available from the Permanent Fund Division (Division) of the Department of Revenue.

Here is the chart we use to make the calculations:

Pursuant to AS 37.13.140(a), the “income available for distribution” in any given fiscal year is equal to “21 percent of the net income of the fund for the last five fiscal years, including the fiscal year just ended” before the PFD is distributed the following October. The “net income of the fund,” referred to by the PFC as “statutory net income” (SNI), is published by the PFC monthly as part of its “History and Projections” report.

To calculate the “income available for distribution” for Fiscal Year (FY) 2017 (Dividend (Calendar) Year 2016), the first year in which the PFD was cut, we start the chart with the SNI reported by the PFC for FY2012. Consistent with the statute, the “income available for distribution” for FY2017 is “21 percent of the net income of the fund” for FY2012 – 2016. As reflected on the chart, for FY2017, that amount was $2.758 billion. The gross amount that, by statute, “shall” be transferred to the dividend fund is equal to 50% of that amount or, for FY2017, $1.379 billion.

Once transferred to the “dividend fund,” which is administered by the Division, AS 43.23.025(a)(1) provides for four adjustments. The first (subsection (B)) is positive – “the unexpended and unobligated balances of prior fiscal year appropriations that lapse into the dividend fund under AS 43.23.045(d).” The other three, provided in AS 43.23.025(a)(1)(C) – (E), are negative. The amounts of each adjustment are published annually in the Division’s Annual Report. We include the net amount of the adjustments in our chart.

We have estimated the amount of the adjustments for Dividend Year 2023 because the Division has not yet published its annual report for that year. For lack of a better measure, the estimate is equal to the average of net adjustments made in the prior seven years.

Once the net amount is determined, the amount per PFD is calculated by dividing the net amount by the number of authorized recipients. The number of recipients is available from the Division’s website at “Summary of Dividend Applications & Payments” (Summary).

To determine the amount withheld and taxed, we compare the resulting statutory PFD with the amount actually paid. The Division publishes the amount actually paid each year on its website in its Summary.

Here is another way of looking at the result:

The actual amount paid each year is in blue; the amount of the cut is in red. The total amount of the statutory PFD is the sum of the two (at the top of each bar). The gold line is the cumulative amount cut (taxed) per PFD over the period.

In sum, the cut exceeded the amount paid – in other words, it was more than 50% of the total statutory amount – in five of the eight years and on average (the last bar on the right) over the entire eight years.

Some sometimes take issue with our description of the cuts as a tax. Typically, part of that argument is that it’s not a tax because the full amount doesn’t pass through the recipient’s hands. But that’s no different than happens at the federal level with payroll and income taxes. As with PFD cuts, the portion taxed is withheld and diverted to government before it ever reaches the recipient’s bank account. It doesn’t become any less of a tax because it never reaches the recipient’s hands.

Others claim that the portion withheld is not a tax because the federal government doesn’t treat the portion withheld as income for federal income tax purposes. But there are many categories of what economists regard as personal income that aren’t subject to federal income tax. PFD cuts are just another. Still, others claim that cuts are not a tax because the amount was not appropriated by the Legislature to be paid. But the reduced appropriation (and diversion elsewhere) is the means of effectuating – implementing – the tax; it doesn’t avoid the fact that a cut to the statutory – what even the Legislature’s own Legislative Finance Division refers to as the “current law” – PFD is a tax.

At the end of the day, as Harvard and Yale-trained and long-time University of Alaska – Anchorage Institute of Social and Economic Research Professor of Economics Matthew Berman said just last year in an op-ed in the Anchorage Daily News, “Let’s be honest. A cut in the PFD is a tax — the most regressive tax ever proposed.”

Typically, once we provide the answer above to those asking what the statutory PFD would have been in past years, a few also ask for a projection of what future PFDs may look like.

That requires a number of assumptions, but as part of our work, we do keep an internal chart that provides estimates. Here it is:

To calculate, we start with the projections of future SNI from the PFC’s most recent “History and Projections” report, turning those into projections of “Income Available for Distribution” using the same statutory formula as we described above. For lack of a better number, we continue to use the same amount for “Adjustments” we used for FY2024. For the number of recipients, we use the last number reported by the Division (624,354 for Dividend (Calendar) Year 2023), escalated thereafter by 1% annually.

Driven largely by the PFC’s projection of growing SNI, the resulting statutory PFD projections also grow over the period, starting at $3,644 per PFD for the current dividend (calendar) year and reaching $4,400 per PFD by dividend (calendar) year 2032. Some claim that is “huge” growth, justifying cuts (a “windfall tax”) to more “reasonable” levels, but the actual overall compound growth rate is only 2.4%. That is no more than roughly the currently projected inflation rate over the period.

For those interested, we also publish a look at projected PFD levels under other various scenarios as part of our regular monthly “Investment Chart” series. Here is the most recent look at projected “Gross PFD” levels ($billions), taken from our June 2024 “Investment Chart” series published earlier this week based on the PFC’s May 2024 History and Projections report:

The numbers for the statutory (current law) PFD are the same as those in the column in the previous chart headed by “Statutory PFD (Gross).” The numbers for the other approaches are calculated at the same level, i.e., before adjustments. The numbers reflecting the calculation of the PFD at various percent of market value (POMV) levels are based on the annual POMV draw projections included in the PFC’s most recent “History and Projections” report. The numbers reflecting the “Leftover” approach are the amount remaining after deducting the spending levels projected in our regular “Friday ‘Goldilocks’ Charts” (which are based on the adjournment spending levels adopted this session by the Legislature, escalated at 2.5% annually) from the annual POMV draw projected by the PFC.

The projected PFD level under each approach can be calculated by subtracting the projected adjustments from the gross amount included on the chart and then dividing the difference by the projected number of recipients.

The result is this:

The projected average statutory (current law) PFD over the next nine years is $3,908. In succession, the projected average PFD resulting from POMV 50/50 is approximately 20% less than that, the projected average PFD resulting from POMV 33/67 is 45% less, the projected average PFD resulting from POMV 25/75 is 60% less, and, based on the current outlook, the projected average PFD resulting from the “Leftover PFD Approach” is 65% less.

For those who view the issue in the same way we do, those are the effective targeted tax rates on statutory PFD income under each approach. For those who analogize PFDs to inheritance or other unearned passive income, again, as we do, those are unheard-of tax levels on that particular type of overall income.